What is a stock split?

A stock corporation can decide to increase the number of its shares to boost the stock´s liquidity.

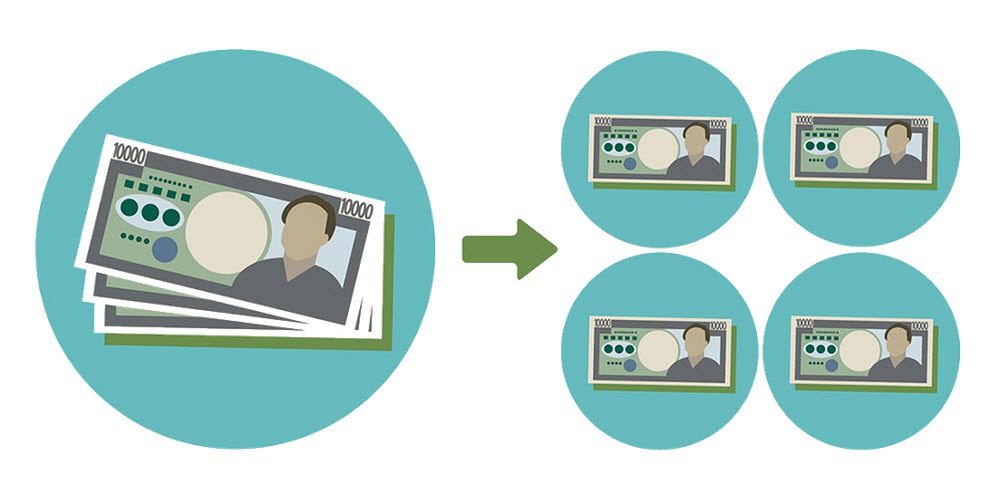

The number of shares will be increased by a specific multiple (e.g. each existing share turns into three shares) and the new shares goes to the current shareholders. Since the split does not fundamentally change the value of the company, the combined value of all shares will remains the same. The

company´s total market capitalization is not changed by the split.

Example: One share in Company XYZ is traded at $120. It is split into three shares. Each share is traded at $40.

Why?

As mentioned above, a company can elect to do a stock split to boost the stock´s liquidity.

When a share becomes very pricey, it can dampen its liquidity since buying it will cost a lot. One extreme example is Berkshire Hathaway Inc Class A which currently trades for more than 429,819 USD per share. If you wanted to put 100 of these shares in your portfolio, it would require an investment of nearly 43 million USD.

Because of this, a company can decide to do a stock split to intentionally bring each share’s price down without decreasing the company´s total market capitalization.

One real-world example is Apple. Since the IPO in December 1980, when Apple went public at $22 per share, Apple´s stock has split five times. The stock split on a 2-for-1 basis on June 16, 1987, June 21, 2000, and February 28, 2005. It then split on a 7-for-1 basis on June 9, 2014 and then on a 4-for-1 basis on August 28, 2020.

Another example if Walmart. Between its IPO in October 1970 and March 1999, Walmart carried out 11 stock splits on a 2-for-1 basis. This meant that an investor who purchased 100 shares at the IPO and then held on to them had 204,800 shares after stock-split #11.

Split ratios

It is up to the company to decide the split ratio.

The most commonly used ones are 2-for-1 (one share is split into two) and 3-for-1 (one share is split into three).

Stock split considerations

Pros

- Can increase market demand for the shares.

- Greater liquidity may narrow the bid-ask spread, which in turn may increase market demand even more.

- Even though a split does not directly impact a company’s market capitalisation, the split typically results in increased market demand which in turn increases the share price, which means a higher market capitalization.

- Many investors interpret this as a bullish signal when a blue chip company carries out a stock split. It is interpreted as proof of the executive-level people having a very strong confidence in the company and wanting to create a larger runway for growth.

- If we look at history, it is not unusual for the market to react so favourably to a stock split that the individual share price fairly quickly reaches its pre-split level.

Cons

- A stock-split is not for free, since it comes with significant administrative costs for the company. The process requires legal oversight to ensure that laws and other regulatory frameworks are adhered to, such as the rules of the exchange where the shares are listed.

- Some experts have spoken out against stock splits, arguing that they attract “the wrong kind” of investors, i.e. speculators rather than serious longer-term investors who actually care about the company’s longer-term future.

- Many stock exchanges do not allow extremely low-priced shares (“penny stocks”) to be traded on them. Nasdaq does for instance prohibit stock that trade below 1 USD/share. A temporary dip below $1 is tolerated, but if the share price remains below $1 for 30 consecutive days the company will be issued a compliance warning. It can be de-listed if it does not become compliant within 180 days. Companies that are already traded at a price close to the minimum level are therefore discouraged from carrying out stock-splits, even if they believe it might boost trader interest in the stock.

Stock split example

In August 2020, Apple (AAPL) carried out a 4-for-1 stock-split. Each share was split into four shares. If you had 1 share before the split, you would have 4 shares afterwards.

Right before the split, AAPL shares traded for circa $540 per share. Right after the split, the price per share at the market open was circa $135. This makes sense, because 540 / 4 = 135.

Before the split, Apple had circa 3.4 billion outstanding shares. After the split, they had circa 13.6 billion outstanding shares, since 3.4 x 4 = 13.6.

The market capitalization remained largely unchanged.

$540 x 3.4 = 1836

$135 x 13.6 = 1836

I own shares in a company that is planning a stock split – what will happen?

Recorded shareholders will automatically receive additional shares when a stock split is carried out.

Example: You are the recorded shareholder of 100 shares in a company. The company carries out a 2-for-1 split. You are now the recorded shareholder of 200 shares in the company.

What is scrip issue?

In British English, a stock split is commonly referred to as scrip issue, capitalization issue, bonus issue, or free issue.

Dividends

If a company pays regular and stable dividends, the dividend per share will typically be adjusted proportionately after a stock-split to keep the overall dividend payment the same.

Voting rights

Stock-splits are non-dilutive. The shareholders will retain the same voting rights as before the split, sine they receive the new shares proportionately to how many shares they already own.

What is a reverse stock split?

A company doing a reserved stock split will decrease the number of shares outstanding, thereby raising the share price without impacting the company´s market capitalization.

- The most common reason for a reverse stock split is to keep the company from being de-listed from an exchange. As mentioned above, stock exchanges tend to have a minimum share price requirement, and if the price of a share drops below this level for a certain number of days, the company can be de-listed.

- Certain mutual funds do not invest in stocks priced below a certain minimum level, which is another reason for companies to carry out a reverse stock split.

- Very low-priced shares (“penny stocks”) are known to be appealing to people carrying out pump-and-dump schemes, so doing a reverse stock split can be a way of staying off their radar.

What is a reverse/forward stock split?

A reverse/forward stock split is carried out when a company wishes to eliminate shareholders holding less than a certain number of shares.

The firs step is a reverse stock split, and the second step is a normal (forward) stock split. This means that the number of outstanding shares is reduced and then increased.

The reverse split reduces the number of shares per shareholder, and shareholders holding less than the minimum number of shares required by the split will be cashed out.

The remaining shareholders will then see their number of shares increased again by the forward share split.

This article was last updated on: September 19, 2022