Archives: How Do Tariffs and Trade Barriers Affect the Economy?

Understanding Tariffs and Trade Barriers

Tariffs and trade barriers are pivotal in shaping the dynamics of the global economy. They influence trade between nations and have substantial effects on domestic markets. These measures are implemented by governments for numerous reasons, ranging from protecting emerging industries to maintaining a balanced trade economy and managing domestic political pressures. While tariffs and trade barriers can confer benefits to specific sectors, their broader economic consequences are significant and multifaceted.

Tariffs: A Closer Look

Tariffs represent taxes levied by governments on imported goods, aiming to increase the cost of foreign products. Such an increase is intended to make domestic products more competitive within national markets. Tariffs are typically structured in two forms: specific tariffs and ad valorem tariffs.

Specific tariffs involve a set fee per unit of the imported item, irrespective of its value. For instance, a fixed charge may be placed on each imported unit of steel. In contrast, ad valorem tariffs are based on a percentage of the item’s total value. For example, a 10% tariff on imported electronics means the tariff increases proportionally with the goods’ price.

While tariffs have the principal advantage of protecting domestic industries from foreign competition, they often result in increased prices for consumers. This can negatively impact consumer purchasing power and limit product choice in the market. In an era of globalization and interdependence, tariffs can provoke retaliatory measures from other countries, which may escalate into trade disputes or even trade wars.

Impact on Domestic Economy

The introduction of tariffs can initially foster domestic production by insulating local industries from foreign competition, potentially leading to short-term job preservation. Local firms, under the protection of tariffs, might increase their output to meet domestic demand and maintain employment levels.

Nonetheless, without the pressure of external competition, domestic industries might suffer from reduced motivation to innovate or improve efficiency. Moreover, while tariffs contribute to government revenue, their fiscal significance can vary significantly based on a country’s economic configuration and level of trade dependence.

Effects on International Trade

Globally, tariffs can induce trade diversions, prompting countries to redirect trade towards alternative markets or suppliers that present more favorable economic terms. This reshuffling of trade patterns can disrupt existing economic relationships and lead to new alliances. Countries affected by tariffs might implement countermeasures, potentially leading to disrupted supply chains and fostering a climate of economic uncertainty.

Exploring Trade Barriers

Trade barriers extend beyond tariffs to encompass a range of methods employed to influence the cross-border flow of goods and services.

Non-Tariff Barriers

These barriers include quotas, embargoes, and strict regulations regarding product safety and standards. Quotas, for example, limit the volume of certain goods that can be imported over a specific timeframe, designed to provide local industries a competitive edge.

Embargoes are another form of non-tariff barrier, representing a complete ban on trade with particular countries. Often politically motivated, embargoes serve as a tool for foreign policy, aiming to influence the behavior or policies of the target nation.

Impact of Non-Tariff Barriers

The impact of non-tariff barriers can be as profound as that of tariffs, often exerting a greater influence on reshaping economic landscapes. While they can elevate domestic safety standards and environmental protections, they also carry the risk of market isolation.

Faced with trade barriers, countries might innovate by developing novel trade practices or even exploring black markets. Yet, these adaptations may not always conform to international standards or local regulations, potentially leading to legal challenges or additional regulatory burdens.

Conclusion

Tariffs and trade barriers are integral components of national economic strategies, utilized to protect domestic markets and pursue various policy objectives. Nonetheless, their wide-reaching effects on the global economic ecosystem can lead to unintended outcomes for both domestic and international players. Policymakers must weigh the benefits of such measures against their potential drawbacks to achieve sustained, equitable economic growth. For those interested in further exploration, international trade organizations offer valuable resources to better understand the ongoing impacts of tariffs and trade barriers.

Archives: What is Foreign Direct Investment (FDI) and Why is It Important?

Understanding Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) refers to an investment made by a firm or individual in one country into business interests located in another country. Typically, FDI occurs when an investor establishes foreign business operations or acquires foreign business assets, including establishing ownership or controlling interest in a foreign company. This is distinguished from foreign portfolio investments, where investors only purchase equities in foreign markets. The nuances of FDI make it a critical element in international finance and economics, connecting businesses and economies at a global level. By engaging in FDI, companies can diversify their business risk, access new markets, and leverage cost efficiencies.

Mechanisms of FDI

FDI can be achieved in various ways, which include developing joint ventures, acquiring a stake in an existing foreign firm, or establishing a new venture in the host country. This process embodies the complexities and strategies businesses adopt to integrate globally. Joint ventures allow foreign companies to collaborate with local firms, utilizing local knowledge and resources, thereby minimizing risks associated with entering new markets. Acquiring stakes in existing companies enables immediate access to local markets while circumventing the challenges of starting anew. Meanwhile, establishing a new venture provides full control over operations and strategy, albeit with higher initial costs and risks.

The relationship between the parent company and the subsidiary is fundamental in FDI. The parent company directs operations, ensuring alignment with its broader business goals, while the subsidiary operates on the ground, adapting to local conditions. This dynamic plays a significant role in how businesses manage cross-border investments and adapt to diverse economic environments.

The Importance of FDI in Global Economics

FDI plays a pivotal role in the interconnectedness and interdependence of world economies. It serves as a conduit for economic growth, technological advancement, and social development across different regions. Here are some key aspects of why FDI is essential:

Economic Growth and Development: FDI contributes significantly to the GDP of host countries, particularly in developing nations where capital is often scarce. Investments stimulate industrial growth, providing the necessary infrastructure and capital to develop industries. This industrial growth, in turn, results in the creation of jobs, directly affecting the employment rate and driving the economic engine of the host country forward.

Knowledge Transfer: An often-overlooked advantage of FDI is the transfer of technology and knowledge. When multinational companies invest in a foreign market, they bring with them cutting-edge technologies and innovative practices. These advances are disseminated within the host country’s industries, elevating productivity levels and enabling local firms to climb the technological ladder. This knowledge transfer can be transformative, modernizing sectors that were previously stagnant.

Increase in Employment: By establishing new businesses or expanding existing ones, FDI creates jobs, bolstering employment opportunities in the host country. The influx of new companies increases demand for skilled and unskilled labor, which not only reduces unemployment rates but also impacts poverty levels positively, contributing to the social stability of the region.

FDI and Multi-National Enterprises (MNEs)

Multi-National Enterprises (MNEs) are cornerstone players in FDI, largely driving its growth. MNEs, through their expansive networks, bring best practices in management, technology adoption, and adherence to international environmental standards to the regions they invest in. They utilize global resources, distributing inputs and outputs across multiple locations, thereby creating efficiencies in production and reducing costs. As they operate in various countries, MNEs help integrate local firms into global supply chains, enhancing their competitiveness on a global stage.

Through FDI, MNEs also serve as channels for cultural exchange, leading to an understanding and appreciation of diverse business practices and consumer markets. This global exchange enriches both the parent and host economies, underscoring the mutual benefits of such investments.

Challenges of Foreign Direct Investment

Despite the myriad benefits it offers, FDI presents several challenges. One major concern is the potential erosion of economic sovereignty in host countries. When foreign entities acquire substantial stakes in local businesses, there is a risk of external influence over domestic policies and economic strategies. Furthermore, an over-dependence on foreign investment can lead to vulnerabilities, especially if investors choose to withdraw during economic downturns.

Moreover, while MNEs often bring higher environmental standards, they can, if unregulated, exploit a host country’s natural resources, leading to environmental degradation. This underscores the importance of robust regulatory frameworks to ensure that FDI aligns with national interests and contributes positively to the local economy and environment.

Issues related to cultural and operational differences also pose challenges. Adjusting to local customs and business etiquette can be complicated for foreign firms, and without careful navigation, these differences can lead to misunderstandings and operational disruptions.

To mitigate such risks, host countries need to establish clear policies and frameworks that encourage beneficial FDI while protecting national interests. This includes setting terms for investment limits, profit repatriation rules, and ensuring that foreign companies adhere to local laws and regulations.

For more in-depth information on Foreign Direct Investment, visit this UNCTAD resource. This site offers detailed insights into global trends and statistics on FDI.

In conclusion, FDI is a foundational element of global economic development, fostering an ecosystem of shared growth and prosperity. By strategically managing FDI policies, countries can spur sustainable development and ensure that the benefits of investment are equitably distributed among their populations. The future of FDI lies in its balanced integration into national economies, ensuring that it sustains growth while preserving economic and environmental integrity.

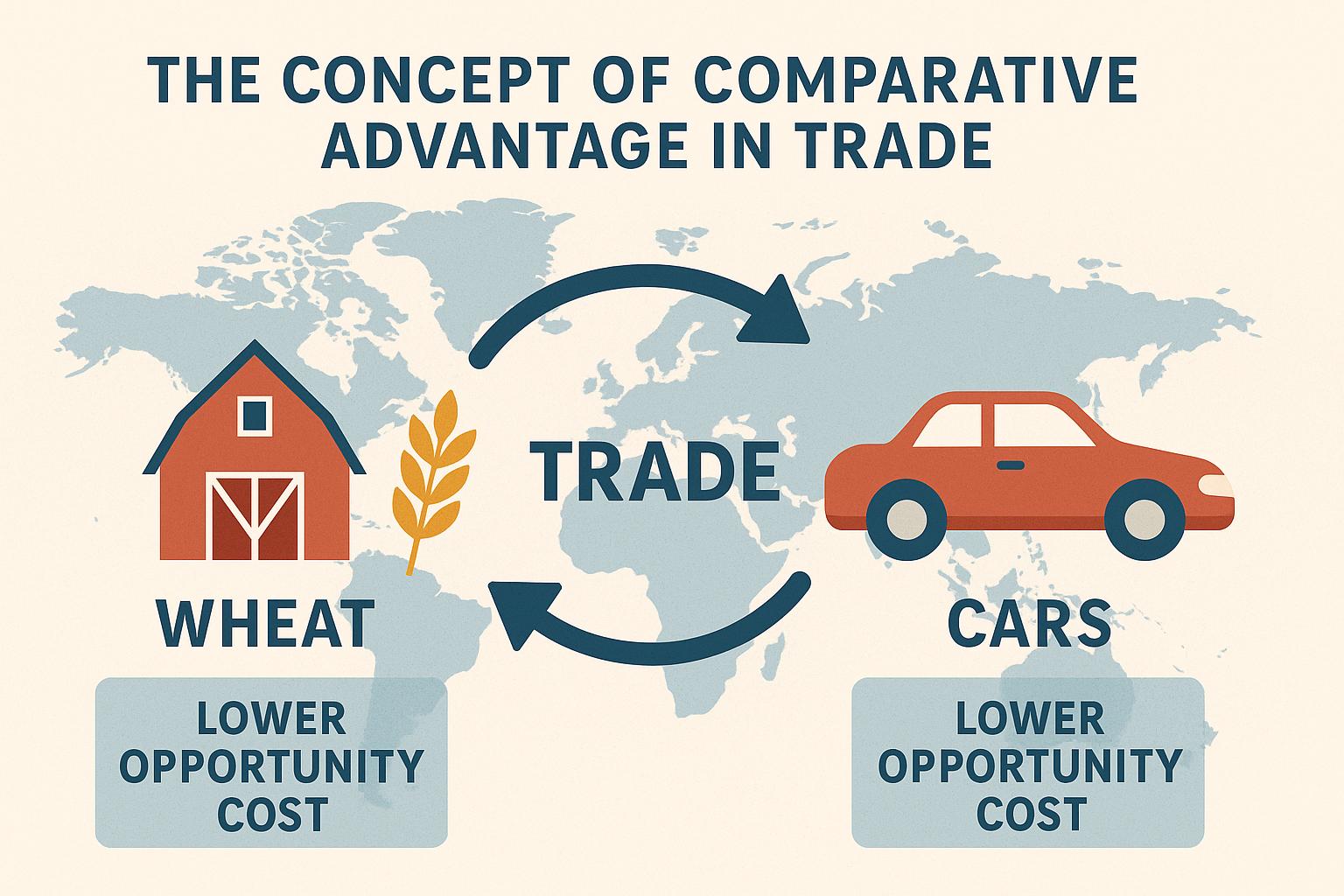

Archives: The Concept of Comparative Advantage in Trade

Understanding Comparative Advantage

The concept of comparative advantage is foundational to the modern understanding of international trade. It elucidates why countries may benefit from engaging in trade, even when one country displays a higher efficiency in producing all goods compared to another. Introduced by the economist David Ricardo in the early 19th century, comparative advantage posits that countries should concentrate their production efforts on goods for which they hold a relative efficiency advantage.

Absolute Advantage vs. Comparative Advantage

To adequately comprehend comparative advantage, it is useful to differentiate it from absolute advantage. A nation possesses an absolute advantage when it can produce a given good with greater efficiency than any other nation. Conversely, comparative advantage highlights the efficiency of producing one good relative to other goods within the same country.

Understanding Opportunity Cost

The crux of understanding comparative advantage lies within the concept of opportunity cost, defined as the value of what must be sacrificed to produce an additional unit of a product. A country boasts a comparative advantage in the production of a good if its opportunity cost is lower than that of other countries. For instance, if Country A has the capability to produce both cars and textiles more efficiently than Country B, yet the opportunity cost of producing cars remains less than that of textiles, Country A should concentrate its production on cars.

Benefits of Specialization and Trade

Countries can gain from trade by focusing on the production of goods where they possess a comparative advantage. This focus results in improved efficiency and enhanced total production capabilities. By participating in trade, countries may acquire more of other goods at a lower opportunity cost as opposed to producing them internally.

A Practical Example

To better illustrate this concept, consider two hypothetical countries: Country X and Country Y. Country X can produce either 10 units of product A or 20 units of product B with identical resources. In contrast, Country Y can produce either 15 units of product A or 5 units of product B. Here, Country X demonstrates a comparative advantage in producing product B, while Country Y exhibits a comparative advantage in product A. When both countries specialize in the products of their respective comparative advantages and engage in trade, each can obtain a greater quantity of both products compared to producing both independently.

Historical Context and Evolution of Comparative Advantage

The theory of comparative advantage has undergone significant evolution since its inception. Ricardo’s initial formulation was relatively simplistic, primarily focusing on labor as the sole input. However, over time, economists have developed more sophisticated models that incorporate multiple inputs and sectors. These advances have enriched our understanding of how comparative advantage operates in a diversified and complex global economy.

The Heckscher-Ohlin Model

One notable development in the field was the introduction of the Heckscher-Ohlin model in the early 20th century. This model expands on Ricardo’s theory by considering the relative abundance of various production factors like land, labor, and capital. Countries are expected to export goods that heavily utilize their abundant resources, further supporting the principle of comparative advantage.

Comparative Advantage in the Age of Technology

The advent of technology has further reshaped the landscape of comparative advantage. Advances in technology can alter a country’s comparative advantage by changing production efficiencies and capabilities. As technological innovation progresses, countries must remain adaptable, re-evaluating their comparative advantages and adjusting their trade strategies accordingly.

Implications for Economic Policy

Understanding comparative advantage bears significant implications for crafting economic policy. Policymakers can utilize this concept to determine strategic sectors for investment and development, ensuring that national resources are allocated efficiently. Moreover, trade agreements and partnerships might be negotiated based on areas where a country holds a strong comparative advantage, maximizing mutual benefits.

The Role of Comparative Advantage in Developing Economies

For developing economies, leveraging comparative advantage can serve as a catalyst for growth and development. By specializing in industries where they hold a comparative advantage, developing nations can increase exports, earn foreign exchange, and accelerate industrialization. Additionally, engaging in international trade can facilitate technology transfer and skill development, crucial components for sustainable economic progress.

Challenges and Criticisms

Despite its widespread acceptance and application, the theory of comparative advantage is not without its critics. Some argue that the model oversimplifies the complexities of international trade and fails to account for certain real-world dynamics.

Complexities of Global Supply Chains

In today’s interconnected economy, global supply chains have become highly intricate and multifaceted. The simple bilateral trade scenarios often depicted in comparative advantage models rarely encompass the full scope of contemporary international trade, where intermediate goods cross multiple borders before final assembly.

Environmental and Social Considerations

Critics also point to the environmental and social implications of strict adherence to comparative advantage. For example, intensive specialization in agriculture or manufacturing can lead to environmental degradation and unsustainable resource exploitation. Additionally, focusing solely on economic efficiency might overlook social welfare considerations, such as fair labor practices and income distribution.

Mitigating Shortcomings Through Policy

To address these shortcomings, it is essential for policymakers to integrate a more holistic approach to economic strategy. This includes balancing comparative advantage with environmental sustainability initiatives and ensuring that social equity considerations are embedded within trade policies.

Conclusion

In summation, the concept of comparative advantage remains a cornerstone of international trade theory, providing valuable insight into how nations can optimize their production and consumption patterns. While it is not without its challenges, understanding and applying comparative advantage thoughtfully can lead to enhanced economic efficiency, increased trade, and mutually beneficial international relationships. As the global economy continues to evolve, the principles of comparative advantage will undoubtedly adapt, continuing to inform trade policies and economic strategies around the world.

Categories

- Uncategorized

(31)

(31)