Category: Uncategorized

- Written by: admin

- Category: Uncategorized

- Published: October 17, 2025

Understanding Economic Bubbles

Economic bubbles are a fascinating phenomenon in financial markets, marked by the rapid escalation of asset values beyond their fundamental worth. These occurrences are often fueled by rising speculative demand. Typically, a bubble begins when investors believe that the recent upward trend in asset prices will continue indefinitely, encouraging further investment and driving prices even higher.

Historical Context

The phenomenon of economic bubbles is not a modern invention; rather, it dates back several centuries and spans various asset classes. From real estate to commodities and even stocks, bubbles have repeatedly formed and burst in different economic environments.

One of the earliest and most famous examples is the Dutch Tulip Mania of the 17th century. During this period, tulip bulbs became highly coveted, leading to skyrocketing prices that eventually collapsed. Speculators paid exorbitant sums for tulip bulbs, convinced that prices would keep climbing. When reality set in, the value of tulips plummeted, leaving many investors with significant losses.

In more recent history, the Dot-com Bubble of the late 1990s serves as a notable case study. Driven by speculative investment in technology and internet-based companies, asset prices soared far beyond their practical value. As the market adjusted and companies failed to deliver on their promises, the bubble burst, resulting in massive losses.

Phases of a Bubble

Economic bubbles typically progress through several recognizable phases:

Stealth Phase

During the stealth phase, a small group of discerning investors recognizes the potential in a particular asset. They begin accumulating shares or commodities, convinced of their long-term profitability and growth potential.

Awareness Phase

As price increases become noticeable, broader awareness builds. More investors are drawn to the asset, further raising demand and pushing prices even higher. The awareness phase often sees early adopters gaining substantial returns on their initial investments.

Mania Phase

The mania phase is characterized by widespread public interest, often fueled by media coverage. The general public, tempted by tales of easy profits, enters the market en masse. This leads to a frenzied buying spree, driving prices to exorbitant levels that are unsustainable.

Blow-off Phase

In the blow-off phase, the bubble reaches its peak. Prices become untenable, and demand begins to wane. As reality reasserts itself and speculative fervor subsides, prices plummet. The crash that follows can wipe out significant wealth and lead to broader economic repercussions.

Market Crashes

Market crashes are sudden, severe declines in the stock market’s value. These events can occur when bubbles burst, though they may also arise from other catalysts. Factors such as economic shocks, political instability, or shifts in investor sentiment can trigger sudden declines.

Key Characteristics

Market crashes share several defining characteristics, the most prominent being rapid sell-offs. As panic spreads through investor communities, seemingly small changes in market conditions can lead to massive sell pressures. Investors, eager to prevent further losses, rush to offload their assets, exacerbating the market’s downturn.

This panic can lead to significant economic consequences, rippling through businesses and impacting employment, production, and global markets. Crashes tend to highlight vulnerabilities in economic structures, leading to calls for reevaluation and reform in financial systems.

Examples of Market Crashes

Two significant market crashes illustrate the severe impact these events can have:

The Great Depression (1929)

The 1929 stock market crash marked the beginning of the Great Depression, a decade-long global economic downturn that was aggravated by excessive speculation and an over-reliance on volatile stocks. The subsequent economic hardship underscored the need for diversified investments and regulatory safeguards.

The Financial Crisis (2008)

Originating from the collapse of the United States housing market, the 2008 financial crisis was precipitated by high-risk mortgage lending and the failure of major financial institutions. As liquidity dried up and panic spread, global economies suffered, underscoring the interconnectedness of modern financial systems.

Prevention and Management

Complete avoidance of economic bubbles and market crashes is challenging, yet their impact can be softened through strategic management and preventative measures. Regulatory oversight must be strengthened to detect and mitigate speculative excesses. Implementing prudent financial practices, such as maintaining diverse investment portfolios and adequate liquidity, is crucial.

Stress testing financial institutions can reveal vulnerabilities, allowing for corrective action before a crisis escalates. Furthermore, informed decision-making by investors, backed by thorough analysis and skepticism of unsustainable trends, can provide a degree of protection against bubble formations and market crashes.

Financial literacy, awareness, and proactive risk management are vital in minimizing the adverse effects of economic cycles. By promoting these principles, economies can enhance their resilience against future financial upheavals.

Understanding economic phenomena like bubbles and market crashes requires a comprehensive approach, integrating historical lessons with modern financial tools. For those interested in a deeper exploration of economic theories and market dynamics, resources in finance and economics offer invaluable insights.

- Written by: admin

- Category: Uncategorized

- Published: October 9, 2025

The Impact of Globalization on the Economy

Globalization, a multifaceted phenomenon, has woven economies around the world into an interconnected web. This interconnectedness has brought both opportunities and challenges, fundamentally reshaping economic landscapes. To understand the full scope of globalization’s impact, it is essential to explore its various dimensions, such as trade, investment, labor markets, and technology.

Trade and Economic Growth

One of the most significant effects of globalization is the increase in international trade. By reducing trade barriers and facilitating the exchange of goods and services, globalization has contributed to substantial economic growth. Nations can specialize in producing goods where they have a comparative advantage, leading to enhanced efficiency and productivity. According to the World Bank, global trade has expanded significantly over the past decades, driving economic growth and lifting millions out of poverty.

While the expansion of trade has been crucial for economic development, it is not without challenges. Increased competition has put pressure on domestic industries, which sometimes results in job losses and economic disparity. Local enterprises often find it challenging to compete with foreign entities that may have access to cheaper resources and labor. Though consumers benefit from a diverse array of goods and services at lower prices, this comes at a cost for domestic producers who must innovate or risk being outpaced by imported products. This dynamic prompts a restructuring of entire industries and can lead to significant shifts in economic power within countries.

Additionally, the global supply chain has emerged as a critical element of international trade. It enables companies to source components from various countries, optimizing cost and efficiency. However, this complexity also introduces vulnerabilities. Disruptions in one part of the world can ripple through the global supply chain, affecting production timelines and economic stability across regions. The COVID-19 pandemic exemplified these vulnerabilities, where production stoppages and logistical hurdles markedly disrupted global trade flows.

Foreign Direct Investment

Globalization has facilitated foreign direct investment (FDI), where multinational corporations invest in businesses and operations overseas. This influx of capital can lead to economic development and job creation in host countries. For instance, FDI often brings new technologies, expertise, and infrastructure improvements. Such investments may lead to the modernization of industries, giving local economies a significant boost in terms of employment and technological competency.

The influx of FDI also plays a crucial role in balancing economic disparities between developed and developing nations. By channeling resources into projects that might otherwise lack funding, FDI can accelerate growth in regions that need it most. Developing countries often see this as an opportunity to integrate into the global economic system, aspiring to raise their standards of living.

Nevertheless, reliance on FDI can also render economies vulnerable to external economic shocks. Sudden withdrawal of foreign investments can destabilize local markets, leading to economic downturns and increased volatility. Countries that become heavily dependent on FDI often face challenges when foreign companies decide to relocate due to better opportunities elsewhere, changes in economic policies, or instability. Therefore, balancing foreign investment with sustainable local economic practices is crucial to avoid over-dependence on external capital and ensure that the benefits of FDI lead to long-term developmental gains.

The Labor Market and Employment

Globalization has transformed labor markets worldwide. The increased mobility of labor and the outsourcing of jobs to countries with lower labor costs have dramatically altered employment patterns. This shift has provided opportunities for emerging economies, enabling them to participate more actively in the global market. Many developing countries have seen significant employment growth in sectors such as manufacturing, where they have a comparative advantage.

Conversely, in developed nations, the outsourcing trend has contributed to wage stagnation and job insecurity, particularly in sectors that rely on semi-skilled labor. This has resulted in a workforce paradigm where jobs requiring lower skills are outsourced, while there is simultaneously an increased demand for highly skilled labor. The subsequent wage disparity emphasizes the importance of education and training systems capable of equipping workers with the skills necessary to thrive in a competitive global marketplace.

Governments face the ongoing challenge of aligning their labor force’s skills with the demands of a rapidly evolving economic landscape. Initiatives aimed at enhancing education and fostering vocational training have become imperative. Such programs not only support economic growth but also help mitigate the negative effects of job displacement and wage inequality. Addressing these issues is critical to ensuring that the benefits of globalization are evenly distributed across all segments of society.

Technological Advancements

Technological innovation serves both as a driver and a beneficiary of globalization. Advances in communication and transportation technologies have enabled businesses to operate and manage supply chains on a global scale efficiently. These advancements foster greater productivity and economic integration, facilitating a rapid exchange of ideas and innovation. The internet, for example, has drastically increased the speed and reach with which information is disseminated, shortening timeframes and reducing costs for businesses worldwide.

However, rapid technological change can also cause economic dislocation, as certain jobs are increasingly automated or made obsolete by artificial intelligence and other technological advancements. This shift necessitates a reevaluation of workforce planning and policies to address these disruptions. It is vital for policymakers to anticipate these changes and implement strategies that support worker retraining and adaptation, ensuring that technological growth translates into economic opportunities rather than widespread displacement.

Moreover, technology has had a profound impact on how economies grow. It has allowed businesses to tap into global markets, reaching customers and suppliers worldwide. This capability is transforming traditional economic industries and giving rise to entirely new sectors, such as the digital and gig economies. As these sectors continue to expand, they will play a pivotal role in shaping future economic policies and practices.

Conclusion

In summary, globalization has significantly impacted the global economy, fostering growth and prosperity while also presenting challenges. The benefits include increased trade, investment opportunities, and technological advancements. However, these come with complications like job dislocation, economic dependency, and inequality. Understanding these dimensions allows policymakers to harness the positive aspects of globalization while mitigating its adverse effects, ensuring an inclusive and sustainable economic future.

Building comprehensive policies that address the complexities of globalization is essential to maximizing its benefits and minimizing drawbacks. Reinforced by supportive legal frameworks and international cooperation, nations can craft strategies that promote equitable growth, encourage innovation, and safeguard against vulnerabilities. Sustainable economic practices, guided by thorough analysis and forward-thinking, will be central to navigating the interconnected future of the global economy.

- Written by: admin

- Category: Uncategorized

- Published: October 9, 2025

Understanding Microeconomics and Macroeconomics

In the field of economics, there are two primary branches that help us analyze economic activities at different scales: microeconomics and macroeconomics. Both branches are crucial for understanding how economies function, but they focus on different aspects of economic activity.

Microeconomics: The Study of Individual Agents

Microeconomics is concerned with the behaviors and decisions of individual economic units. This includes consumers, businesses, and industries. By analyzing these entities, microeconomics seeks to understand how they respond to changes in market conditions, such as changes in prices or resource availability.

The primary focus areas of microeconomics include:

Consumer Behavior: Microeconomics delves into how individuals make purchasing decisions based on their preferences and budget constraints. Consumers aim to maximize their utility, which is the satisfaction derived from consuming goods and services. The study of consumer behavior often involves understanding the law of demand, which outlines the inverse relationship between price and quantity demanded, and how consumer preferences and income levels shape choices.

Firm Production and Costs: Microeconomic theory examines how firms determine their production levels and set product prices. This involves the study of production functions, which show the relationship between inputs, like labor and capital, and outputs. Costs are analyzed through concepts like fixed and variable costs, which influence firms’ pricing strategies and profit maximization. The intersection of supply and demand curves is a fundamental concept in determining market equilibrium prices and quantities.

Market Structures: Microeconomics explores various market structures, including perfect competition, monopoly, and oligopoly. Each structure impacts pricing and availability differently. In perfect competition, many small firms sell identical products, leading to minimal control over prices. In contrast, a monopoly exists when a single company dominates a market, enabling price setting above competitive levels. Oligopoly markets have a few firms influencing each other’s decisions, often resulting in strategic pricing and production choices.

Microeconomic analysis often involves examining a single market or sector, providing insights into the dynamics of supply and demand, price elasticity, and resource allocation. The study of elasticity helps economists understand the responsiveness of quantity demanded or supplied to changes in price or other factors, which is critical for businesses and policymakers.

Macroeconomics: The Study of the Economy as a Whole

Contrasting microeconomics, macroeconomics looks at the economy on a larger scale. It involves analyzing aggregate economic indicators and examining the overall economic environment within a country or globally.

Key areas of macroeconomic analysis include:

National Production and Income: Macroeconomics assesses the total economic output of a nation through metrics like Gross Domestic Product (GDP). GDP measures the value of all finished goods and services produced within a country’s borders in a specific time period. It is a primary indicator of a country’s economic health, providing insights into the size and efficiency of an economy.

Inflation and Deflation: This area involves analyzing changes in the price level across the economy and their impacts on purchasing power and business planning. Inflation signifies a general increase in prices, reducing the purchasing power of money, while deflation denotes a decrease in prices. Monitoring inflation rates is crucial for economic stability, as high inflation erodes incomes and savings, while deflation can lead to reduced consumer spending and economic contraction.

Unemployment Rates: Macroeconomics evaluates joblessness within the economy to determine economic health and the effectiveness of labor policies. Different types of unemployment, such as cyclical, structural, and frictional, are studied to design policies that could help achieve full employment. The unemployment rate is a key indicator of economic health, reflecting the percentage of the labor force that is actively seeking employment but cannot find work.

Fiscal and Monetary Policies: These policies are pivotal in steering the economy’s direction and stability. Fiscal policy involves government decisions on taxing and spending to influence the economic activity, while monetary policy, often managed by central banks, involves regulating the money supply and interest rates. During economic downturns, expansionary fiscal and monetary policies are commonly employed to stimulate growth, whereas contractionary policies might be applied to curb inflation.

Macroeconomics provides a broad overview of economic activity and helps policymakers design strategies for economic growth, stability, and development. By understanding these aggregate factors, economists and policymakers can make informed decisions that affect a country’s or region’s economic performance and well-being.

Interconnections Between Micro and Macro

Though distinct, microeconomics and macroeconomics are interrelated. Changes in the macroeconomic environment, like a shift in fiscal policy, might affect microeconomic decisions, such as a firm’s investment strategies. For example, an increase in interest rates might lead businesses to invest less due to higher borrowing costs, impacting production levels and employment.

Similarly, the collective behaviors and decisions of individual consumers and firms can influence macroeconomic trends. Aggregate demand is the total demand for goods and services within an economy, influenced by consumer spending, business investments, government expenditure, and net exports. Individual consumer decisions, therefore, contribute to overall economic conditions like inflation and employment rates.

Moreover, microeconomic policies focusing on specific industries can have broader implications for macroeconomic outcomes. For instance, targeted subsidies or tax incentives for renewable energy can lead to technological advancements and shifts in labor markets, influencing the national or global economy.

Conclusion

Understanding both microeconomic and macroeconomic perspectives is essential for a comprehensive understanding of economic issues. While microeconomics focuses on the trees, macroeconomics examines the forest. Analyzing both aspects provides valuable insights for individuals, businesses, and governments alike in their decision-making processes.

For individuals, understanding microeconomic concepts like personal budgeting and consumption choices can lead to better financial planning. Businesses, on their part, benefit from microeconomic insights that guide production efficiency, market positioning, and competitive strategies. On a broader scale, macroeconomic analysis helps businesses anticipate trends and plan for future growth, considering factors like interest rates and economic cycles.

Governments and policymakers rely on macroeconomic analysis to design effective policies that promote economic stability, growth, and equitable distribution of resources. By studying both micro and macroeconomic principles, those responsible for fiscal and monetary policies can craft strategies aimed at sustaining economic progress and improving the quality of life for their citizens.

In sum, a comprehensive approach that incorporates both microeconomic and macroeconomic analysis offers a well-rounded perspective on economic phenomena, enhancing our understanding of the complex and interdependent world of economics.

- Written by: admin

- Category: Uncategorized

- Published: September 25, 2025

Understanding Tariffs and Trade Barriers

Tariffs and trade barriers are pivotal in shaping the dynamics of the global economy. They influence trade between nations and have substantial effects on domestic markets. These measures are implemented by governments for numerous reasons, ranging from protecting emerging industries to maintaining a balanced trade economy and managing domestic political pressures. While tariffs and trade barriers can confer benefits to specific sectors, their broader economic consequences are significant and multifaceted.

Tariffs: A Closer Look

Tariffs represent taxes levied by governments on imported goods, aiming to increase the cost of foreign products. Such an increase is intended to make domestic products more competitive within national markets. Tariffs are typically structured in two forms: specific tariffs and ad valorem tariffs.

Specific tariffs involve a set fee per unit of the imported item, irrespective of its value. For instance, a fixed charge may be placed on each imported unit of steel. In contrast, ad valorem tariffs are based on a percentage of the item’s total value. For example, a 10% tariff on imported electronics means the tariff increases proportionally with the goods’ price.

While tariffs have the principal advantage of protecting domestic industries from foreign competition, they often result in increased prices for consumers. This can negatively impact consumer purchasing power and limit product choice in the market. In an era of globalization and interdependence, tariffs can provoke retaliatory measures from other countries, which may escalate into trade disputes or even trade wars.

Impact on Domestic Economy

The introduction of tariffs can initially foster domestic production by insulating local industries from foreign competition, potentially leading to short-term job preservation. Local firms, under the protection of tariffs, might increase their output to meet domestic demand and maintain employment levels.

Nonetheless, without the pressure of external competition, domestic industries might suffer from reduced motivation to innovate or improve efficiency. Moreover, while tariffs contribute to government revenue, their fiscal significance can vary significantly based on a country’s economic configuration and level of trade dependence.

Effects on International Trade

Globally, tariffs can induce trade diversions, prompting countries to redirect trade towards alternative markets or suppliers that present more favorable economic terms. This reshuffling of trade patterns can disrupt existing economic relationships and lead to new alliances. Countries affected by tariffs might implement countermeasures, potentially leading to disrupted supply chains and fostering a climate of economic uncertainty.

Exploring Trade Barriers

Trade barriers extend beyond tariffs to encompass a range of methods employed to influence the cross-border flow of goods and services.

Non-Tariff Barriers

These barriers include quotas, embargoes, and strict regulations regarding product safety and standards. Quotas, for example, limit the volume of certain goods that can be imported over a specific timeframe, designed to provide local industries a competitive edge.

Embargoes are another form of non-tariff barrier, representing a complete ban on trade with particular countries. Often politically motivated, embargoes serve as a tool for foreign policy, aiming to influence the behavior or policies of the target nation.

Impact of Non-Tariff Barriers

The impact of non-tariff barriers can be as profound as that of tariffs, often exerting a greater influence on reshaping economic landscapes. While they can elevate domestic safety standards and environmental protections, they also carry the risk of market isolation.

Faced with trade barriers, countries might innovate by developing novel trade practices or even exploring black markets. Yet, these adaptations may not always conform to international standards or local regulations, potentially leading to legal challenges or additional regulatory burdens.

Conclusion

Tariffs and trade barriers are integral components of national economic strategies, utilized to protect domestic markets and pursue various policy objectives. Nonetheless, their wide-reaching effects on the global economic ecosystem can lead to unintended outcomes for both domestic and international players. Policymakers must weigh the benefits of such measures against their potential drawbacks to achieve sustained, equitable economic growth. For those interested in further exploration, international trade organizations offer valuable resources to better understand the ongoing impacts of tariffs and trade barriers.

- Written by: admin

- Category: Uncategorized

- Published: September 11, 2025

Understanding Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI) refers to an investment made by a firm or individual in one country into business interests located in another country. Typically, FDI occurs when an investor establishes foreign business operations or acquires foreign business assets, including establishing ownership or controlling interest in a foreign company. This is distinguished from foreign portfolio investments, where investors only purchase equities in foreign markets. The nuances of FDI make it a critical element in international finance and economics, connecting businesses and economies at a global level. By engaging in FDI, companies can diversify their business risk, access new markets, and leverage cost efficiencies.

Mechanisms of FDI

FDI can be achieved in various ways, which include developing joint ventures, acquiring a stake in an existing foreign firm, or establishing a new venture in the host country. This process embodies the complexities and strategies businesses adopt to integrate globally. Joint ventures allow foreign companies to collaborate with local firms, utilizing local knowledge and resources, thereby minimizing risks associated with entering new markets. Acquiring stakes in existing companies enables immediate access to local markets while circumventing the challenges of starting anew. Meanwhile, establishing a new venture provides full control over operations and strategy, albeit with higher initial costs and risks.

The relationship between the parent company and the subsidiary is fundamental in FDI. The parent company directs operations, ensuring alignment with its broader business goals, while the subsidiary operates on the ground, adapting to local conditions. This dynamic plays a significant role in how businesses manage cross-border investments and adapt to diverse economic environments.

The Importance of FDI in Global Economics

FDI plays a pivotal role in the interconnectedness and interdependence of world economies. It serves as a conduit for economic growth, technological advancement, and social development across different regions. Here are some key aspects of why FDI is essential:

Economic Growth and Development: FDI contributes significantly to the GDP of host countries, particularly in developing nations where capital is often scarce. Investments stimulate industrial growth, providing the necessary infrastructure and capital to develop industries. This industrial growth, in turn, results in the creation of jobs, directly affecting the employment rate and driving the economic engine of the host country forward.

Knowledge Transfer: An often-overlooked advantage of FDI is the transfer of technology and knowledge. When multinational companies invest in a foreign market, they bring with them cutting-edge technologies and innovative practices. These advances are disseminated within the host country’s industries, elevating productivity levels and enabling local firms to climb the technological ladder. This knowledge transfer can be transformative, modernizing sectors that were previously stagnant.

Increase in Employment: By establishing new businesses or expanding existing ones, FDI creates jobs, bolstering employment opportunities in the host country. The influx of new companies increases demand for skilled and unskilled labor, which not only reduces unemployment rates but also impacts poverty levels positively, contributing to the social stability of the region.

FDI and Multi-National Enterprises (MNEs)

Multi-National Enterprises (MNEs) are cornerstone players in FDI, largely driving its growth. MNEs, through their expansive networks, bring best practices in management, technology adoption, and adherence to international environmental standards to the regions they invest in. They utilize global resources, distributing inputs and outputs across multiple locations, thereby creating efficiencies in production and reducing costs. As they operate in various countries, MNEs help integrate local firms into global supply chains, enhancing their competitiveness on a global stage.

Through FDI, MNEs also serve as channels for cultural exchange, leading to an understanding and appreciation of diverse business practices and consumer markets. This global exchange enriches both the parent and host economies, underscoring the mutual benefits of such investments.

Challenges of Foreign Direct Investment

Despite the myriad benefits it offers, FDI presents several challenges. One major concern is the potential erosion of economic sovereignty in host countries. When foreign entities acquire substantial stakes in local businesses, there is a risk of external influence over domestic policies and economic strategies. Furthermore, an over-dependence on foreign investment can lead to vulnerabilities, especially if investors choose to withdraw during economic downturns.

Moreover, while MNEs often bring higher environmental standards, they can, if unregulated, exploit a host country’s natural resources, leading to environmental degradation. This underscores the importance of robust regulatory frameworks to ensure that FDI aligns with national interests and contributes positively to the local economy and environment.

Issues related to cultural and operational differences also pose challenges. Adjusting to local customs and business etiquette can be complicated for foreign firms, and without careful navigation, these differences can lead to misunderstandings and operational disruptions.

To mitigate such risks, host countries need to establish clear policies and frameworks that encourage beneficial FDI while protecting national interests. This includes setting terms for investment limits, profit repatriation rules, and ensuring that foreign companies adhere to local laws and regulations.

For more in-depth information on Foreign Direct Investment, visit this UNCTAD resource. This site offers detailed insights into global trends and statistics on FDI.

In conclusion, FDI is a foundational element of global economic development, fostering an ecosystem of shared growth and prosperity. By strategically managing FDI policies, countries can spur sustainable development and ensure that the benefits of investment are equitably distributed among their populations. The future of FDI lies in its balanced integration into national economies, ensuring that it sustains growth while preserving economic and environmental integrity.

- Written by: admin

- Category: Uncategorized

- Published: September 4, 2025

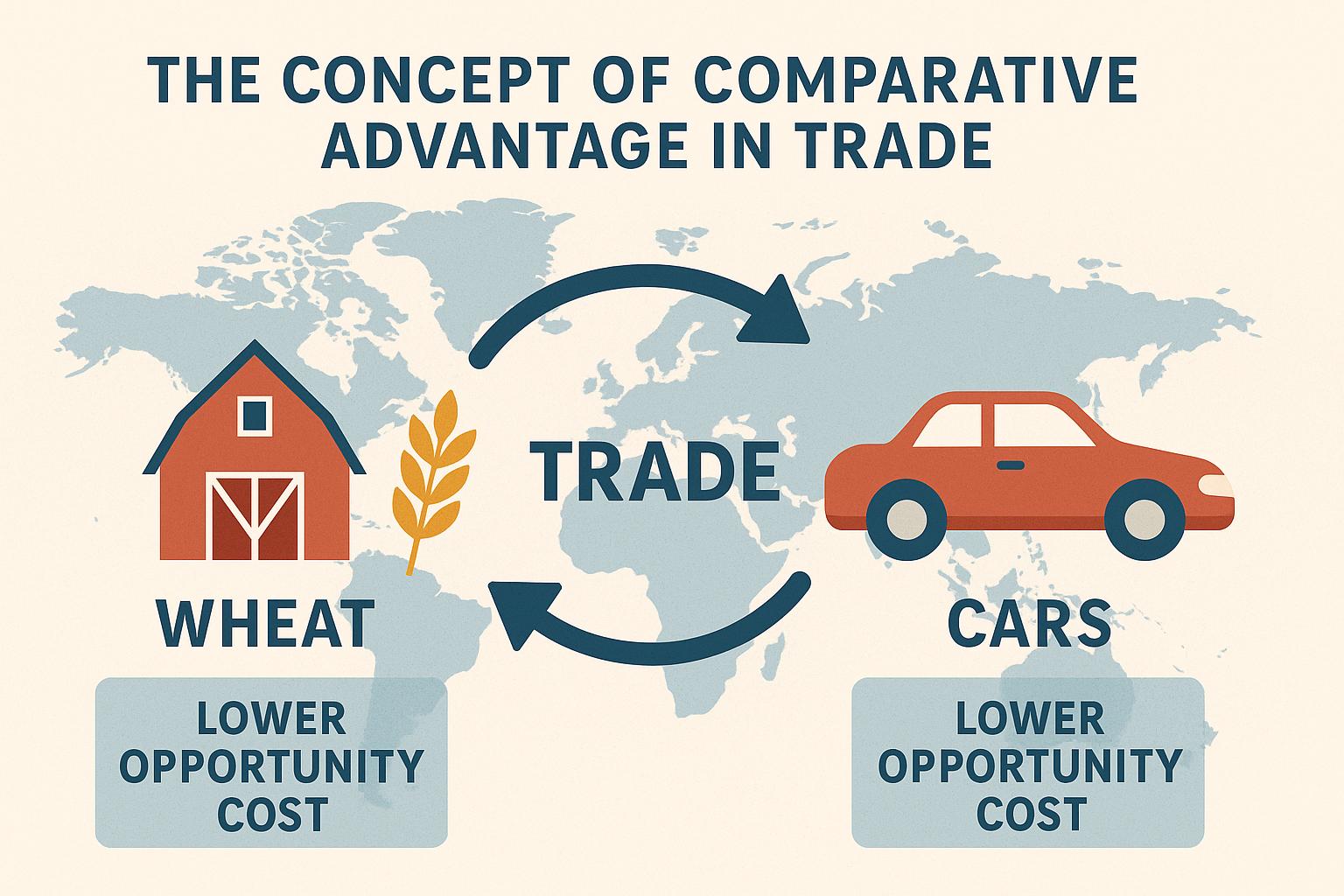

Understanding Comparative Advantage

The concept of comparative advantage is foundational to the modern understanding of international trade. It elucidates why countries may benefit from engaging in trade, even when one country displays a higher efficiency in producing all goods compared to another. Introduced by the economist David Ricardo in the early 19th century, comparative advantage posits that countries should concentrate their production efforts on goods for which they hold a relative efficiency advantage.

Absolute Advantage vs. Comparative Advantage

To adequately comprehend comparative advantage, it is useful to differentiate it from absolute advantage. A nation possesses an absolute advantage when it can produce a given good with greater efficiency than any other nation. Conversely, comparative advantage highlights the efficiency of producing one good relative to other goods within the same country.

Understanding Opportunity Cost

The crux of understanding comparative advantage lies within the concept of opportunity cost, defined as the value of what must be sacrificed to produce an additional unit of a product. A country boasts a comparative advantage in the production of a good if its opportunity cost is lower than that of other countries. For instance, if Country A has the capability to produce both cars and textiles more efficiently than Country B, yet the opportunity cost of producing cars remains less than that of textiles, Country A should concentrate its production on cars.

Benefits of Specialization and Trade

Countries can gain from trade by focusing on the production of goods where they possess a comparative advantage. This focus results in improved efficiency and enhanced total production capabilities. By participating in trade, countries may acquire more of other goods at a lower opportunity cost as opposed to producing them internally.

A Practical Example

To better illustrate this concept, consider two hypothetical countries: Country X and Country Y. Country X can produce either 10 units of product A or 20 units of product B with identical resources. In contrast, Country Y can produce either 15 units of product A or 5 units of product B. Here, Country X demonstrates a comparative advantage in producing product B, while Country Y exhibits a comparative advantage in product A. When both countries specialize in the products of their respective comparative advantages and engage in trade, each can obtain a greater quantity of both products compared to producing both independently.

Historical Context and Evolution of Comparative Advantage

The theory of comparative advantage has undergone significant evolution since its inception. Ricardo’s initial formulation was relatively simplistic, primarily focusing on labor as the sole input. However, over time, economists have developed more sophisticated models that incorporate multiple inputs and sectors. These advances have enriched our understanding of how comparative advantage operates in a diversified and complex global economy.

The Heckscher-Ohlin Model

One notable development in the field was the introduction of the Heckscher-Ohlin model in the early 20th century. This model expands on Ricardo’s theory by considering the relative abundance of various production factors like land, labor, and capital. Countries are expected to export goods that heavily utilize their abundant resources, further supporting the principle of comparative advantage.

Comparative Advantage in the Age of Technology

The advent of technology has further reshaped the landscape of comparative advantage. Advances in technology can alter a country’s comparative advantage by changing production efficiencies and capabilities. As technological innovation progresses, countries must remain adaptable, re-evaluating their comparative advantages and adjusting their trade strategies accordingly.

Implications for Economic Policy

Understanding comparative advantage bears significant implications for crafting economic policy. Policymakers can utilize this concept to determine strategic sectors for investment and development, ensuring that national resources are allocated efficiently. Moreover, trade agreements and partnerships might be negotiated based on areas where a country holds a strong comparative advantage, maximizing mutual benefits.

The Role of Comparative Advantage in Developing Economies

For developing economies, leveraging comparative advantage can serve as a catalyst for growth and development. By specializing in industries where they hold a comparative advantage, developing nations can increase exports, earn foreign exchange, and accelerate industrialization. Additionally, engaging in international trade can facilitate technology transfer and skill development, crucial components for sustainable economic progress.

Challenges and Criticisms

Despite its widespread acceptance and application, the theory of comparative advantage is not without its critics. Some argue that the model oversimplifies the complexities of international trade and fails to account for certain real-world dynamics.

Complexities of Global Supply Chains

In today’s interconnected economy, global supply chains have become highly intricate and multifaceted. The simple bilateral trade scenarios often depicted in comparative advantage models rarely encompass the full scope of contemporary international trade, where intermediate goods cross multiple borders before final assembly.

Environmental and Social Considerations

Critics also point to the environmental and social implications of strict adherence to comparative advantage. For example, intensive specialization in agriculture or manufacturing can lead to environmental degradation and unsustainable resource exploitation. Additionally, focusing solely on economic efficiency might overlook social welfare considerations, such as fair labor practices and income distribution.

Mitigating Shortcomings Through Policy

To address these shortcomings, it is essential for policymakers to integrate a more holistic approach to economic strategy. This includes balancing comparative advantage with environmental sustainability initiatives and ensuring that social equity considerations are embedded within trade policies.

Conclusion

In summation, the concept of comparative advantage remains a cornerstone of international trade theory, providing valuable insight into how nations can optimize their production and consumption patterns. While it is not without its challenges, understanding and applying comparative advantage thoughtfully can lead to enhanced economic efficiency, increased trade, and mutually beneficial international relationships. As the global economy continues to evolve, the principles of comparative advantage will undoubtedly adapt, continuing to inform trade policies and economic strategies around the world.

- Written by: admin

- Category: Uncategorized

- Published: August 29, 2025

Forex trading has been steadily gaining traction in Kenya over the past decade. With more accessible internet connections, mobile payment systems like M-Pesa, and an increasing number of licensed brokers, retail traders now have direct access to the global currency markets. What was once seen as a niche activity has become a mainstream way for Kenyans to try their hand at active trading.

Regulation and Safety

The Capital Markets Authority (CMA) regulates forex trading in Kenya. This step was crucial, as it reduced the risks associated with unregulated offshore brokers that often targeted retail traders. A CMA license means brokers must follow strict guidelines on transparency, client fund security, and reporting. While many traders still use international brokers, locally regulated firms are seen as safer since disputes can be handled under Kenyan law.

Access and Technology

One of the biggest drivers of forex trading growth in Kenya is mobile accessibility. Many brokers integrate seamlessly with M-Pesa, making deposits and withdrawals fast compared to traditional banking channels. Platforms like MetaTrader 4 and MetaTrader 5 are common, offering charting, technical indicators, and automated trading options. The rise of smartphone trading apps has made it possible for traders to manage positions from anywhere, which fits the Kenyan market’s mobile-first culture.

Risks and Considerations

While forex trading offers opportunities, it also comes with significant risks. Leverage, often marketed as a selling point, magnifies both profits and losses. Many beginners underestimate how quickly an account can be wiped out by poor risk management. Education is another gap—too many traders jump in chasing fast money without learning about position sizing, stop losses, or strategy testing.

Why Education Matters

Traders who invest time into learning the basics—market structure, technical analysis, risk management—tend to last longer in the market. Kenyan universities and training institutions are beginning to offer short courses, but much of the education still comes from online resources and communities.

Where to Learn More

For those looking to understand the forex trading scene in Kenya, the website forex.ke provides updated insights on brokers, regulations, and trading practices that apply directly to the Kenyan market.

Final Thoughts

Forex trading in Kenya is no longer a fringe activity—it’s becoming mainstream, especially among younger traders comfortable with mobile technology. The opportunities are real, but so are the risks. With regulation improving and access easier than ever, the traders who succeed will be those who treat forex not as a quick gamble but as a skill worth developing.

- Written by: admin

- Category: Uncategorized

- Published: August 28, 2025

Understanding a Free Market Economy

A free market economy is an economic system where the prices of goods and services are determined by the forces of supply and demand within an open market. In this environment, the interacting forces of supply and demand are uninfluenced by any governmental or monopolistic interference. This economic model is rooted in the belief that competition fosters efficient resource production and allocation, ultimately benefiting consumers and spurring innovation.

Key Features of a Free Market Economy

A free market economy is characterized by certain distinct features that differentiate it from other economic models:

1. Voluntary Exchange: One of the fundamental aspects of a free market economy is the freedom for individuals and businesses to engage in voluntary trade. In such a marketplace, buyers and sellers can negotiate terms that are mutually beneficial, without any external pressure or coercion. This mechanism helps in the efficient distribution of goods and services, as well as in determining fair prices.

2. Competition: The lack of government interference leads to a competitive business environment. This competition is crucial as it pushes businesses to improve the quality of their goods and services, diversify their offerings, and enhance efficiency. As companies vie for consumers’ attention, the market naturally weeds out less efficient players, leading to a dynamic and self-regulating economic system.

3. Private Property: An essential component of a free market economy is the concept of private property. Individuals have ownership and control over resources and assets, which incentivizes them to innovate and enhance their offerings to maintain a competitive edge. Private ownership also promotes accountability, as individuals are responsible for their property and its productive use.

4. Profit Motive: The driving force behind many activities in a free market economy is the pursuit of profit. This motivation encourages entrepreneurs and companies to take calculated risks and adopt innovative practices, propelling economic growth and development. The quest for profit leads to advancements in technology and processes, fueling a cycle of innovation and efficiency.

The Role of Government in a Free Market Economy

While the principle of minimal government interference is a cornerstone of a free market economy, the government still has significant responsibilities in ensuring its smooth operation. Primarily, governments maintain law and order, protecting property rights and enforcing contracts to create a stable economic environment. This legal framework ensures that businesses can operate efficiently and that consumers have trust in the market’s fairness.

On occasion, governments might intervene to address significant market failures. For example, monopolies can hamper competition, and excessive pollution can harm public welfare. In such cases, governments may implement regulations to correct these imbalances, ensuring that the market remains competitive and sustainable. These interventions are typically designed to preserve the integrity of the market and protect consumers from potential harms.

Advantages of a Free Market Economy

The free market economy offers a range of advantages to both consumers and businesses:

Efficiency: By allowing market forces to set prices, resources are allocated to their most productive uses, minimizing waste and enhancing production efficiency.

Innovation: The drive to outperform competitors leads businesses to invest in new technologies and processes, resulting in a steady stream of innovative products and services.

Consumer Choice: With numerous businesses competing for consumers’ attention, there is a wide array of products and services available, catering to diverse needs and preferences.

Economic Growth: The profit-seeking motive encourages businesses to expand their operations, translating into increased economic activity and job creation.

Challenges of a Free Market Economy

Despite its benefits, a free market economy is not without its challenges:

– Income Inequality: In the absence of regulatory frameworks, disparities in wealth and income can emerge, leading to social inequities and potential unrest.

– Market Failures: Situations can arise where market forces alone fail to achieve optimal outcomes, such as environmental degradation or monopolistic practices. In these instances, government intervention may be required to restore balance.

– Economic Fluctuations: Free markets are susceptible to cycles of boom and bust, which can result in economic instability and uncertainty for businesses and consumers.

The ongoing debate among economists and policymakers revolves around the merits and drawbacks of a free market economy. While the advantages are substantial, striking the right balance between economic freedom and necessary regulation is critical to maximizing potential benefits while minimizing negative impacts. This balance ensures that the economy continues to function efficiently, with the welfare of society as a primary consideration. Through careful consideration and informed policymaking, the free market economy can evolve to meet the needs of an ever-changing world.

- Written by: admin

- Category: Uncategorized

- Published: August 21, 2025

Understanding Debt-to-GDP Ratio

In today’s global economy, the debt-to-GDP ratio stands as a pivotal measure widely employed to assess the fiscal health of a country. This ratio functions as a comparative tool juxtaposing a nation’s public debt with its gross domestic product (GDP), thereby serving as a barometer for the country’s capability to manage and repay its debts. Grasping the intricacies of this ratio enables analysts and stakeholders to better understand the financial stability and economic well-being of nations across the globe.

Calculating the Debt-to-GDP Ratio

The calculation method of the debt-to-GDP ratio is relatively simple, yet it offers profound insights into a country’s financial health. Expressed as a percentage, the debt-to-GDP ratio is derived by dividing the total public debt of a country by its GDP. The formula used is as follows:

Debt-to-GDP Ratio (%) = (Total Public Debt / GDP) × 100

This straightforward equation serves the purpose of quantifying the proportion of a country’s economic output that is necessary to service its public debt. By employing this calculation, governments, economists, and financial analysts can develop a clearer picture of a nation’s fiscal standing.

Significance of the Debt-to-GDP Ratio

The debt-to-GDP ratio holds significant importance as it offers a glimpse into a country’s financial durability. A high debt-to-GDP ratio might suggest that a country could encounter difficulties in settling its debts without incurring additional debt. This scenario can trigger concerns regarding the country’s fiscal management and lead to further implications, such as downgrades in credit rating. On the other hand, a low debt-to-GDP ratio typically reflects a scenario where a nation is generating adequate economic output to efficiently manage its debt obligations. However, it’s crucial to recognize that there isn’t a universally agreed-upon “ideal” debt-to-GDP ratio, as this metric can fluctuate depending on a nation’s unique economic structure and growth prospects.

Implications for Economic Stability

For investors, policymakers, and international financial organizations, the debt-to-GDP ratio acts as a vital indicator of a country’s economic stability. A climbing ratio could signal heightened risks of default, potentially leading to increased borrowing costs for the country. This, in turn, could dampen investor confidence and heighten economic uncertainty. Therefore, fostering sustainable economic growth, maintaining fiscal discipline, and ensuring prudent government spending are essential elements in driving a stable and sustainable debt-to-GDP ratio.

International Comparisons

In the realm of international finance and economics, cross-country comparisons of debt-to-GDP ratios can provide valuable insights, yet they require careful consideration of the distinct economic contexts and characteristics inherent to each nation. For example, developed countries like Japan are sometimes capable of maintaining higher debt-to-GDP ratios without immediate financial distress due to their mature economies and robust internal financing mechanisms. In contrast, emerging economies may find even moderately high debt-to-GDP ratios to be more burdensome, given their smaller economic scale and possibly limited access to financial markets.

When evaluating the debt-to-GDP ratios of different countries, it’s essential to factor in variables such as economic size, growth trends, and historical precedence. Ignoring these considerations can lead to misinterpretations and over-generalizations about countries’ fiscal positions.

Conclusion

The debt-to-GDP ratio offers a critical lens through which to evaluate a nation’s economic health and the efficacy of its fiscal policies. While this measure provides valuable insights into a country’s ability to manage its debts, it is essential to view it in conjunction with other economic indicators for a complete and nuanced analysis. For those seeking additional information on fiscal metrics and the holistic understanding of national economies, reliable financial data sources such as the International Monetary Fund and the World Bank serve as valuable references.

In summary, the debt-to-GDP ratio is a vital metric that contributes to our understanding of a country’s fiscal health and economic performance. Its use, however, must be informed by a broader understanding of various economic factors and contextual knowledge. As the global economy continues to integrate and evolve, maintaining a keen awareness of such metrics will be crucial for stakeholders worldwide.

- Written by: admin

- Category: Uncategorized

- Published: August 10, 2025

Understanding Budget Deficit

A budget deficit takes place when a government’s expenses surpass its revenue over a particular period. This phenomenon is relatively common among nations where spending priorities require more funding than the income generated. Governments generally finance these deficits by borrowing money, often through the issuance of bonds. Gaining a clear understanding of the impacts and implications of a budget deficit is essential for comprehending the broader scope of economic dynamics.

Causes of Budget Deficits

Several factors can contribute to the occurrence of a budget deficit. These factors range from increased government spending on essential programs to inefficiencies within the tax system. Below are some of the primary causes:

One of the most significant causes is increased government spending on key programs like healthcare, education, and defense. When these expenditures rise, often due to policy decisions prioritizing social welfare, the financial requirement may exceed available funds.

Another critical cause is a decrease in revenue from taxes. This can occur during economic downturns when businesses and individuals earn less, translating to lower tax collections. Tax cuts designed to stimulate economic growth may also reduce revenues if they are not offset by increased economic activity. Additionally, inefficient tax systems that fail to capture potential revenue can exacerbate this issue.

Occasionally, governments face unexpected financial crises necessitating emergency spending. Such emergencies can strain financial resources, leading governments to spend beyond their regular budget allocations.

Short-term Effects on the Economy

Despite the potential downsides, budget deficits can have certain short-term benefits for the economy, particularly in stimulating economic growth. When a government increases its spending, it injects additional liquidity into the economy.

Stimulating Economic Growth: By spending more than it collects, the government can invigorate money flow within the economy. When government funds are directed toward projects or services, they often lead to increased consumption of goods and services. This uptick in demand can push businesses to hire more workers and ramp up production, creating a ripple effect of economic activity.

The Keynesian economic theory suggests that during periods of economic recession, purposeful government deficits can help revitalize lukewarm economies. The increased expenditure from the government can induce consumer spending flows, stabilize the market, and reduce unemployment rates.

Long-term Consequences

Although budget deficits might act as a catalyst for short-term economic rejuvenation, their persistence can bring about negative long-term consequences. The implications of sustained deficits need careful management to mitigate potential risks.

Rising National Debt: The continuous funding of budget deficits through borrowing invariably increases a country’s national debt. As the debt accumulates, so does the interest obligation that must be repaid. Eventually, interest payments may consume a significant portion of government expenditures, reducing the available budget for other programs.

Additionally, there is a potential for inflation. As governments continue to borrow and introduce more money into circulation, there is a risk of inflation. Any scenario where there is an abundance of money chasing a limited supply of goods can result in an inflationary environment, diminishing the value of currency and causing price hikes.

Higher Interest Rates: Sustained borrowing can lead to increased interest rates as governments compete with the private sector for financial resources. This competition can make borrowing costlier for businesses and individuals, which might adversely impact private investment. A decline in investment can slow economic growth, creating a more challenging environment for long-term fiscal health.

Managing a Budget Deficit

Managing a budget deficit effectively demands a delicate balance between addressing immediate needs and preserving long-term fiscal health. Some common strategies to tackle these challenges involve a mix of increasing revenue and curbing unnecessary spending.

Tax reforms play a crucial role in boosting government revenue. By ensuring that the tax regime is efficient, equitable, and incentivizes productivity, governments can collect adequate revenue without hindering economic growth.

In parallel, exercising discretion in spending cuts or finding ways to improve efficiency in government programs can reduce unnecessary expenditures. Governments need to identify less critical areas where spending can be optimized or reduced without compromising essential services.

Lastly, implementing prudent monetary policies helps keep inflation in check, stabilizing the economy. Monetary policy can complement fiscal strategies by controlling money supply and interest rates, thus ensuring a balanced approach to economic management.

For individuals and professionals keen on exploring further, numerous government finance agencies and economic research institutions provide insights and analysis on national fiscal policies. Engaging with these resources deepens understanding of the intricate dynamics involved in managing budget deficits and navigating the challenges they present.

In essence, while budget deficits can provide short-term economic stimulation, they also require careful management to avoid long-term fiscal instability. By strategically addressing both revenue and expenditure sides, governments can attempt to ensure sustainable economic growth and fiscal health.