Category: Uncategorized

- Written by: admin

- Category: Uncategorized

- Published: August 3, 2025

Understanding the Concept of Scarcity in Economics

In economics, the concept of scarcity is a principle of paramount importance. This principle is rooted in the very fabric of economic study and discourse, accentuating the inherent limitations present when it comes to fulfilling human needs and wants. At the very core of economic theory is this basic economic problem, which arises due to the stark reality that while resources are finite, human desires for goods and services are boundless and constantly evolving. Such a state of affairs demands that choices and trade-offs become essential in the quest to allocate resources most effectively.

Defining Scarcity

The notion of scarcity, when viewed through an economic lens, refers to the limited nature of resources in comparison to the seemingly unlimited wants of individuals and societies. Resources that hold economic value—land, labor, capital, and entrepreneurship—come with a finite supply. These resources lack the capacity to meet all the desires and needs of a growing population. Consequently, economic agents—whether they are individuals, corporations, or governmental bodies—find themselves in the pivotal position of needing to make crucial decisions about how best to utilize these constrained resources.

The Implications of Scarcity

The far-reaching implications of scarcity permeate multiple facets of economic activity in profound ways:

Choice and Opportunity Cost: The scarcity of resources necessitates that individuals and organizations embark upon decision-making processes to ensure the efficient allocation of resources. This dynamic brings forth the concept of opportunity cost, which denotes the value of the second-best alternative that is foregone when a particular choice is made. To elucidate, consider a scenario where a decision is made to produce an increased quantity of consumer goods; this decision might result in fewer resources being directed towards the production of capital goods, highlighting the trade-offs inherent in economic decision-making.

Resource Allocation: The reality of scarcity gives rise to the need for a mechanism capable of allocating resources in a manner that optimizes both output and efficiency. Within the framework of a market economy, prices frequently assume this critical role, serving as indicators to highlight where resources are most valued and needed.

Economic Systems and Scarcity: Different economic systems—each embodying unique philosophies and approaches—tackle the issue of scarcity through diverse means. The varying degrees to which market forces and governmental intervention are utilized within capitalism, socialism, or mixed economies elucidate the distinct methods for coping with resource allocation.

The Role of Supply and Demand

Supply and demand forces are integral components in the conversation surrounding scarcity. In market dynamics, these forces actively respond to scarce resources through the mechanism of price adjustments. For instance, the price of a particular good or service may increase if it experiences a heightened level of scarcity. This price increase acts as a signal to both consumers and producers, aligning demand with the limited supply available. It is this self-regulating mechanism that directs resources toward their most valued and essential uses within a market economy.

Addressing Scarcity

Efforts to address and effectively manage the challenges posed by scarcity require innovative strategies geared towards increased efficiency and resource exploration. Technology, with its ever-advancing front, provides numerous pathways to enhance production methods and create new alternatives. Scientific innovation often leads to the discovery of alternative resources, thus broadening the range of available options. Moreover, education that emphasizes resource management plays a pivotal role in enabling societies to make informed and prudent decisions. One of the primary goals is to strive toward sustainable development, ensuring that resources are utilized in a manner that benefits both present and future generations.

Conclusion

The concept of scarcity resides at the core of economic thought, serving as the motivational force behind a multitude of economic theories and practices. A firm grasp of scarcity aids in understanding the motives and rationale behind specific economic activities, and it assists in formulating strategies focused on more efficient resource utilization. Both individuals and societies are tasked with navigating the intrinsic limitations posed by scarcity by making informed, strategic decisions. This imperative often necessitates further exploration beyond surface-level understanding. To fully appreciate the complexities of scarcity and its multifaceted impact on economics, readers are encouraged to delve deeper into additional resources or to explore dedicated economic education websites.

- Written by: admin

- Category: Uncategorized

- Published: July 27, 2025

Understanding Stagflation

Stagflation is an economic condition characterized by the simultaneous occurrence of stagnation and inflation. This rare phenomenon can present significant challenges for policymakers and economists. Traditionally, inflation and economic growth are thought to be inversely correlated; however, stagflation represents a deviation from this norm.

Components of Stagflation

Stagnation refers to slow or negligible economic growth, often accompanied by a rise in unemployment rates. During periods of stagnation, an economy may struggle to produce enough jobs, resulting in increased economic hardships for individuals. When economic growth stalls, the production of goods and services declines or remains flat, which affects job creation negatively. Consequently, the unemployment rate rises as businesses feel pressure and may be unable to maintain their workforce levels. Individuals who are unemployed during such times often face significant financial challenges, as the job market becomes highly competitive, with limited opportunities.

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. In normal circumstances, inflation can be a byproduct of healthy economic growth, signifying increased demand. However, when it occurs alongside stagnation, it complicates economic conditions. Inflation in such a scenario means that people are spending more on goods and services while their income remains static or even decreases due to stagnation. This causes distress among consumers, who see their purchasing power diminish as their expenses rise while income remains unchanged.

Possible Causes

Stagflation is typically triggered by a combination of external and internal factors. Key causes include:

1. Supply shocks: Sudden disruptions to the supply chain, such as significant increases in the cost of essential commodities like oil, can contribute to increased production costs, leading to both stagnation and inflation. Supply shocks can abruptly increase the cost of raw materials, making production more expensive and reducing the profitability of businesses. This situation can lead to companies raising prices to maintain profit margins, thus contributing to inflation, while simultaneously cutting jobs or avoiding new hires, which adds to stagnation.

2. Monetary policies: Misguided monetary policies, such as excessive money printing, can cause inflation without corresponding economic growth. When a central bank introduces too much money into the economy without a corresponding increase in goods and services, it may result in more money chasing the same number of goods, which drives prices up. In a stagnant economy, this newly available money does not lead to investment in growth but rather contributes to inflationary pressures.

3. Structural problems: Inefficiencies in an economy, such as inflexible labor markets or regulatory constraints, may hinder growth while allowing inflation to persist. Structural problems can include rigidities in the job market, outdated production technologies, or policies that discourage innovation and entrepreneurship. Even if more jobs are required to stimulate growth, such barriers can prevent effective responses to this need, contributing to ongoing stagnation. At the same time, these inefficiencies can lead to wasted resources, increasing costs, and subsequently driving inflation up.

Why Is Stagflation a Concern?

Stagflation poses a unique challenge since traditional economic policy tools are not well-suited to address it effectively. For example, standard measures to combat inflation, such as raising interest rates, might further stifle economic growth. Conversely, measures designed to stimulate growth, like cutting interest rates, can exacerbate inflation. This creates a difficult situation for policymakers who need to address both stagnation and inflation. The traditional economic toolkits offer solutions that are often contradictory when it comes to stagflation, highlighting the complexity and difficulty of the issue.

Policymaker Challenges

The dilemma arises in choosing the right balance of policies that can address both facets of stagflation. Central banks and governments must carefully design policies that do not amplify either stagnation or inflation. This can involve a mix of monetary and fiscal strategies tailored to the root causes of the specific economic context. Often, policymakers need to adopt a cautious approach, analyzing the specific causes of stagflation in a given situation before implementing measures. This may require innovative solutions or a combination of targeted interventions that aim to address underlying structural issues, improve productivity, and stimulate selective areas of the economy without adding to inflationary pressures.

Stagflation can have lasting effects, eroding consumer and business confidence. It can dampen investment, as businesses remain cautious about future economic conditions. Persistent stagflation can lead to a cycle of reduced productivity and innovation, further entrenching economic stagnation. Businesses are likely to hold back on investments when economic conditions appear uncertain or unprofitable in the long term. Additionally, a pervasive sense of uncertainty can result in delayed consumer spending and cautious financial planning, which further stagnates the economy. The long-term impact of stagflation is significant and can contribute to an environment of economic instability. Businesses, feeling uncertain about market conditions, may hesitate to invest in new ventures or innovation, which further reduces opportunities for growth. Similarly, reduced consumer spending can prompt businesses to limit production and cut workforce numbers, creating a downward economic spiral. Over time, this can become self-reinforcing, as stagnation begets more stagnation, and inflation continues unchecked. For a more in-depth understanding of how economies navigate these challenges, you may consult resources from expert economic institutions, such as the International Monetary Fund. Reliable data and analyses can offer insights into current trends and historical precedents for stagflation management. Studying past instances of stagflation and the measures taken by different economies can provide valuable lessons on how to handle or even prevent such conditions in the future. Understanding stagflation and its implications is crucial, as it strips away the predictability that accompanies traditional economic cycles. Policymakers and businesses must remain vigilant, equipped with flexible strategies to navigate this complex economic environment. Knowledge of stagflation is an essential part of economic literacy, emphasizing the importance of strategic planning and diverse policy tools. Ultimately, the ability to foresee potential challenges arising from stagflation and adapt accordingly will be crucial in ensuring long-term stability and growth.Conclusion

- Written by: admin

- Category: Uncategorized

- Published: July 20, 2025

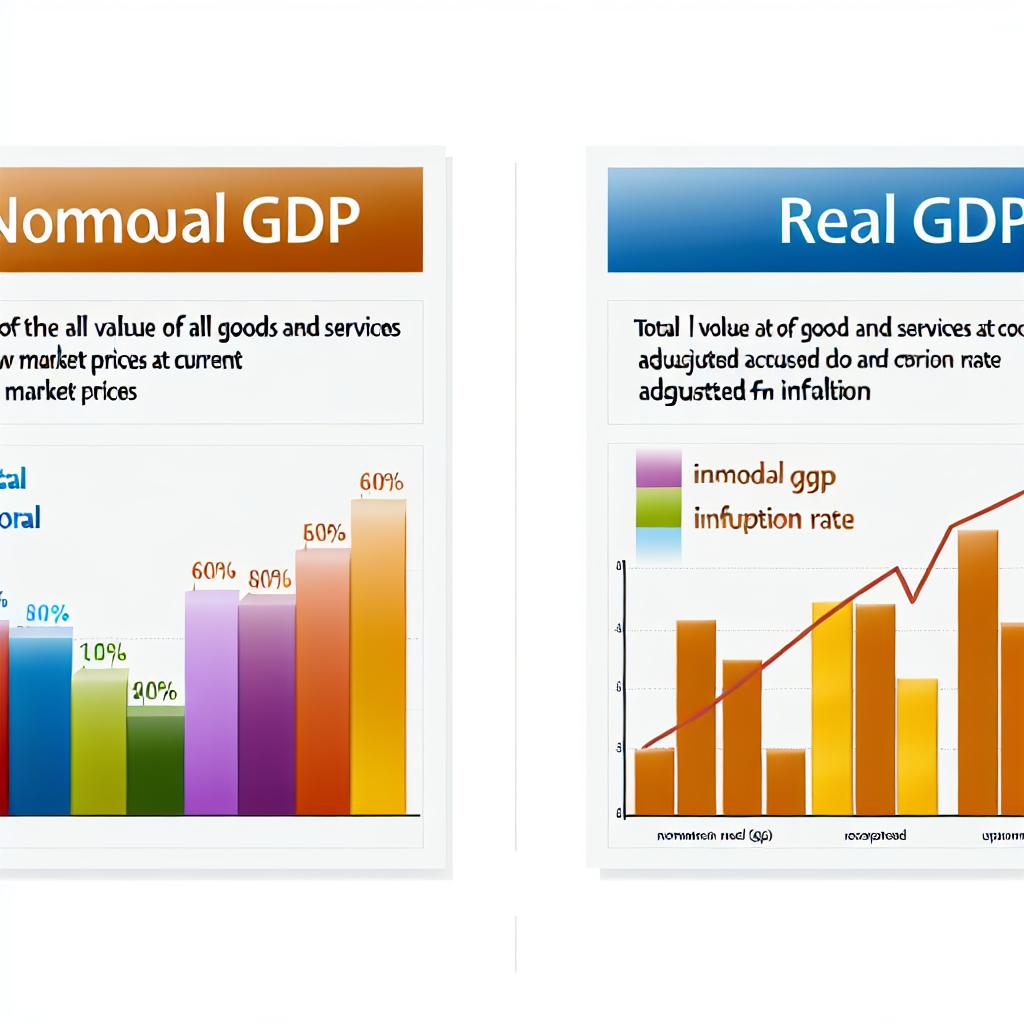

Understanding Nominal GDP

Nominal Gross Domestic Product (GDP) is a fundamental economic indicator that measures a country’s overall economic output in monetary terms using the prevailing market prices of goods and services. This measure does not account for inflation, which means it presents a picture of economic activity based on current price levels. It’s typically calculated over specific periods, such as annually or quarterly, to provide insights into the economic conditions and growth trends of a nation.

Characteristics of Nominal GDP

Nominal GDP has distinct characteristics that make it an essential tool for economists and policy-makers.

Current Prices: This feature indicates that nominal GDP reflects the market value of goods and services using the prices that are current in the year this economic measure is evaluated. Hence, nominal GDP gives the monetary value of economic production without filtering out the impacts of inflation or deflation, which can sometimes skew the perception of actual economic activity.

Economic Indicator: Despite its limitations, nominal GDP offers significant insights into the immediate economic health of a country. It provides a snapshot of the economy’s output, presenting an understanding of the country’s economic activity in terms of money. Observing changes in nominal GDP can help economists identify growth trends and cycles of recessions or expansions.

Inflation Impact: A major limitation of nominal GDP is its susceptibility to inflationary distortions. When there is an increase in the general price level within an economy, nominal GDP might indicate economic growth, even when the actual output volume has stayed the same or decreased. This often requires supplementary data to make accurate assessments and foster informed economic decisions.

To gain comprehensive insights into how GDP is measured, consulting resources from renowned economic institutions, such as The World Bank, could be beneficial.

Understanding Real GDP

Real GDP serves as a crucial tool for assessing the true growth and size of an economy by adjusting nominal GDP figures for the effects of inflation. These adjustments offer a clearer and more consistent representation of economic performance over time, allowing for more accurate comparisons across different periods.

Characteristics of Real GDP

Real GDP also has unique characteristics that make it an invaluable measure of economic performance:

Constant Prices: Unlike nominal GDP, real GDP uses price levels from a base year to eliminate the impact of inflation. By maintaining constant prices, real GDP provides a means of measuring the volume of production and services, rather than just their monetary value at current prices. This way, it isolates and highlights genuine economic growth without being misled by price changes.

Economic Analysis: The use of real GDP plays a critical role in economic analysis, as it offers a more accurate picture of the economy’s underlying growth. This parameter serves as a reliable benchmark to gauge whether an increase in GDP is truly a sign of increased production or merely the result of inflation.

Adjustments for Inflation: With inflation adjustments included in the calculation of real GDP, it becomes a preferred metric among economists who seek to study changes in economic productivity. These adjustments are vital for analyzing long-term growth patterns and identifying whether policies are effectively fostering real growth in economic output.

For further exploration and a deeper understanding of GDP concepts, educational materials from established economic think tanks like The International Monetary Fund can help broaden one’s knowledge.

The Key Differences

The discrepancies between nominal GDP and real GDP predominantly center on their treatment of price changes. Nominal GDP uses current prices, making it a straightforward raw measure that reflects economic activity in monetary terms. In contrast, real GDP adjusts for price variations, thus providing a more stable and reliable metric that allows meaningful comparisons over time.

Why the Differences Matter

The distinction between nominal and real GDP holds great importance for economic analysis and the formulation of economic policies. Understanding whether changes in GDP are driven by genuine growth in production or inflated by rising prices is crucial for policymakers, investors, and economists.

For example, when a country’s nominal GDP increases, it does not necessarily point unequivocally to economic growth. It could either be a result of increased production or merely a reflection of inflation. By examining real GDP alongside nominal GDP, analysts and policymakers can discern the underlying factors influencing growth dynamics. This differentiation aids in the construction of accurate economic models and forecasts, facilitating more effective strategies and interventions.

Reliable decisions in policy-making often hinge on the insights garnered from these GDP comparisons, emphasizing how pivotal it is to analyze both measures in tandem.

For additional detailed insights, consulting sources like The Bank for International Settlements for reports and analytical papers would further enhance your understanding of GDP analysis and its broader implications.

- Written by: admin

- Category: Uncategorized

- Published: July 13, 2025

Understanding Purchasing Power

Purchasing power is a fundamental concept in economics that refers to the value of a currency expressed in terms of the quantity of goods or services that a single unit of money can purchase. This concept is essential for both individual economic decision-making and broader national economic planning. When analyzing purchasing power, understanding its dynamics can help in evaluating economic health and inform strategies for economic development.

In simple terms, purchasing power signifies how much you can buy with a specific amount of money. If an individual has high purchasing power, it means that with a fixed income or amount, they can afford more goods and services. On the other hand, when purchasing power decreases, each unit of currency buys fewer goods and services than before.

Factors Affecting Purchasing Power

Numerous factors can influence purchasing power. Recognizing these allows consumers, businesses, and policymakers to make sound economic decisions to maintain or enhance purchasing power over time.

Inflation

Inflation is perhaps the most critical factor affecting purchasing power. Inflation occurs when there is a general increase in the price level of goods and services in an economy over a period. With inflation, the real value of money decreases, meaning that each monetary unit buys fewer goods and services. For example, with an annual inflation rate of 3%, an item costing $100 today will likely cost $103 next year if prices rise in line with inflation. Therefore, without corresponding income increases, inflation erodes purchasing power over time.

Exchange Rates

Exchange rates play a crucial role, especially for consumers and businesses engaged in international trade. Exchange rates determine the value of one currency relative to another. A stronger domestic currency makes imported goods cheaper, effectively increasing purchasing power. Conversely, a weak currency purchasing foreign goods will buy less, thus reducing purchasing power. Exchange rate fluctuations can therefore have a significant impact on import prices and the cost of living.

Wage Levels

Wages are another pivotal factor in determining purchasing power. If wages grow at a rate that exceeds the inflation rate, individuals effectively have more purchasing power. Conversely, if wage growth lags behind inflation, consumers experience a decrease in purchasing power. Therefore, examining trends in wage levels relative to inflation provides insight into changes in real purchasing power.

Measuring Changes in Purchasing Power

To assess changes in purchasing power, economists and analysts use specific indices that track variations in price levels and cost structures over time.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a widely recognized measure of price level changes and is frequently used to gauge inflation rates. The CPI reflects the average change over time in prices paid by urban consumers for a market basket of goods and services. By tracking the CPI, analysts can infer about shifts in purchasing power as it represents changes in the prices of essential items such as food, housing, and transportation.

Cost of Living Index

The Cost of Living Index provides a broader understanding of purchasing power by comparing the cost of maintaining a certain standard of living in different regions. It considers various factors, such as housing expenses, tax levels, and food costs, giving a more comprehensive view of purchasing power differences across locations. This index helps to account for regional disparities in living costs, which can significantly affect purchasing power.

Implications of Changing Purchasing Power

Fluctuations in purchasing power hold significant implications not just for consumers, but also for businesses and policymakers.

For Consumers

Individual consumers are immediately impacted by changes in purchasing power. A decrease implies that consumers must stretch their dollars further, potentially leading to adjustments in spending patterns. They may need to reduce discretionary spending, save less, or even resort to using their savings to maintain current living standards. Conversely, an increase in purchasing power allows for greater spending flexibility.

For Businesses

Businesses are directly affected by consumers’ purchasing power as it influences demand for their products and services. In response to a shift in purchasing power, companies might alter their pricing strategies, seek cost-effective inputs, or adjust product offerings to better align with consumer abilities and preferences. Firms must remain agile to sustain profitability in light of changing economic realities.

For Policymakers

Government policymakers play a critical role in managing and stabilizing purchasing power through monetary and fiscal policies. Actions such as modifying interest rates, adjusting taxation levels, or implementing subsidies can mitigate adverse effects on purchasing power. Such interventions are aimed at fostering an economically stable environment where purchasing power supports the overall economic welfare of citizens.

In conclusion, purchasing power serves as a vital economic indicator that is shaped by various dynamic factors like inflation, exchange rates, and wage levels. Understanding its intricacies is key to making strategic financial decisions for individuals and enables policymakers to enact initiatives to achieve economic stability and growth. By striving to preserve or increase purchasing power, stakeholders can contribute positively to the economic prosperity of society. Recognizing these dynamics is essential for all who want to navigate the economic landscape effectively.

- Written by: admin

- Category: Uncategorized

- Published: July 6, 2025

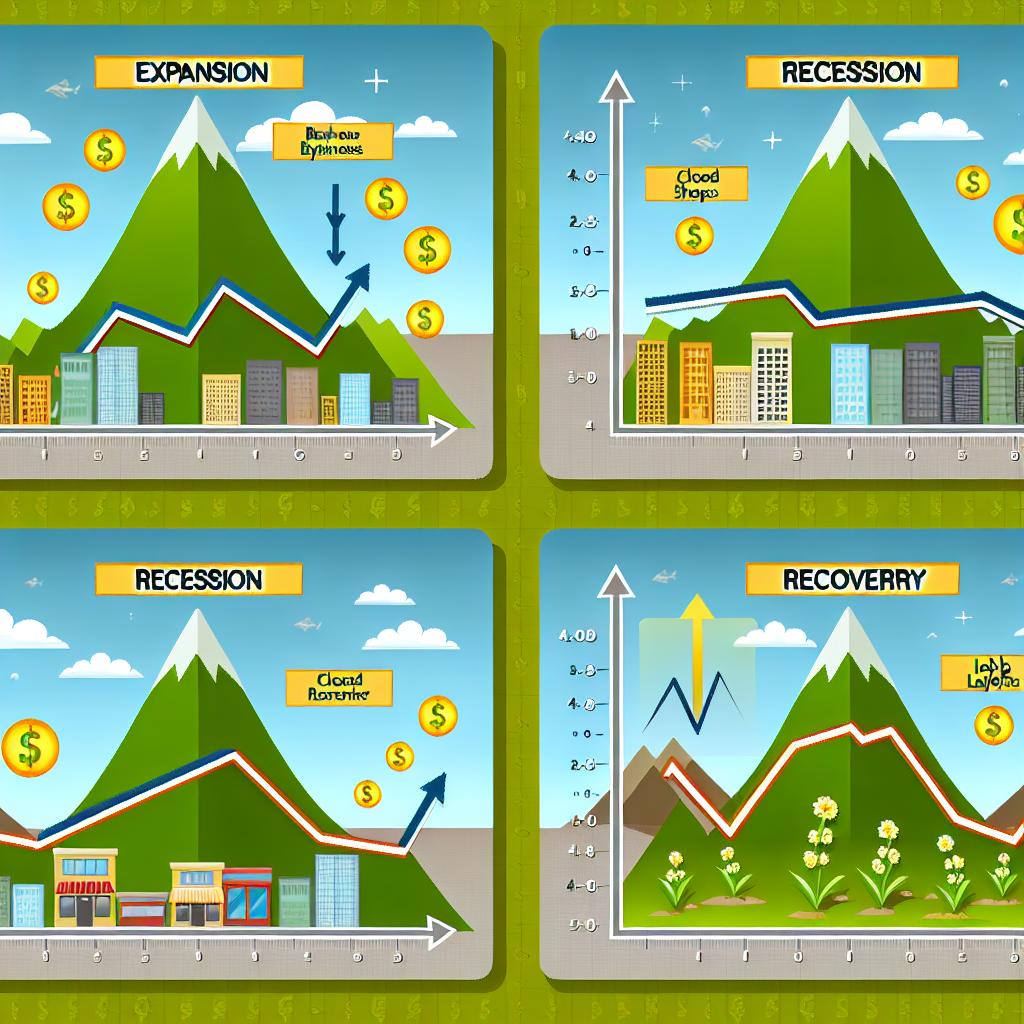

Understanding the Business Cycle

The business cycle remains a fundamental concept within the field of economics, encapsulating the recurrent phases of expansion and contraction in the economic activity of nations over time. These recurring cycles are typically segmented into four primary phases: expansion, peak, recession, and recovery. Each phase is marked by distinct characteristics and exerts different impacts across businesses, consumers, and policymakers.

Expansion

The expansion phase signifies a period in which economic activity witnesses sustained and steady growth. This phase is often regarded as synonymous with economic prosperity, marked by an upsurge in production and employment, along with heightened consumer spending. During expansion, businesses typically report increased profits, which often prompts investments in capital goods. Inflation levels, during the early stages of expansion, tend to remain moderate, providing a conducive environment for economic growth. High consumer confidence further fuels spending, thus facilitating the creation of new jobs and reduction in unemployment rates. The expansion phase is vital for enhancing economic vitality and sets the groundwork for lasting economic development.

Peak

Upon reaching the peak phase, the economy achieves its maximum level of activity. Economic performance metrics—such as Gross Domestic Product (GDP), employment rates, and production levels—achieve their pinnacle during this stage. However, it is also at the peak that inflationary pressures come to the forefront, compelling central banks to take precautionary measures. Such measures may include heightening interest rates to control inflation and stabilize prices. The peak serves as a precursor to a downturn, indicating the impending transition from economic growth to contraction.

Recession

The recession phase is typified by a tangible decline in economic activities across various sectors. Generally, a recession encompasses at least two consecutive quarters of negative GDP growth. Businesses often experience a slump in sales, leading to a cutback in both production and investment endeavors. During this phase, unemployment rates tend to rise as organizations curb hiring or lay off employees. This reduction in workforce often triggers a downturn in consumer confidence, leading to decreased consumer spending, further intensifying the economic downturn. In response, policymakers might initiate fiscal or monetary interventions to counteract the recession and reinvigorate economic growth.

Recovery

Gradually, the economy transitions into the recovery phase following a recession. Recovery is marked by a slow and steady resurgence in economic activities. Businesses begin to resume investments and start hiring once more, signaling an optimistic outlook towards future growth. Consumer spending begins to revive as market confidence is restored. Although the unemployment rate starts to decrease, it may take a while to realign fully to pre-recession levels. The recovery phase is critical, serving as a bridge that leads into the next cycle of economic expansion, thereby continuing the perpetual cycle of economic activity.

Implications for Stakeholders

Comprehending the intricacies of the business cycle is imperative for several stakeholders within the economic ecosystem:

Businesses: Understanding the cycle enables businesses to tailor strategies, such as expanding operations during growth periods and optimizing resources in times of recession.

Consumers: Awareness of economic cycles empowers consumers to make informed decisions concerning financial matters such as spending, saving, and investing.

Policymakers: By closely monitoring the business cycle, governments and central banks can implement economic policies aimed at cushioning adverse effects of cycles and fostering stable, long-term growth.

Conclusion

The business cycle is an inherent aspect of economic dynamics, illustrating the intricate interplay between factors governing economic operations. By grasping the various phases—expansion, peak, recession, and recovery—individuals and institutions can strategically navigate the economic landscape. Each phase offers opportunities and challenges that, when aptly managed, can lead to sustainable economic progress. Should you seek further insights on this pivotal economic concept, a multitude of financial education platforms provide detailed analyses and up-to-date economic forecasts to aid in enhancing economic literacy and planning.

- Written by: admin

- Category: Uncategorized

- Published: June 29, 2025

Understanding Opportunity Cost in Economics

In the realm of economics, the concept of opportunity cost is a pivotal element in decision-making processes. It represents the benefits or value one misses out on when choosing one alternative over another. Understanding opportunity cost is essential for economic agents, including individuals, businesses, and governments, as it aids in making informed choices.

Defining Opportunity Cost

Opportunity cost can be defined as the value of the next best alternative foregone when a decision is made. It is not just about financial costs; instead, it encompasses any kind of profit, benefits, or value that one forgoes. Unlike explicit costs, which involve direct monetary transactions, opportunity cost involves the evaluation of all available alternatives to assess the trade-offs.

The Importance in Resource Allocation

In economics, resources are often limited, and thus, the decision on how to allocate them effectively depends heavily on understanding opportunity cost. For instance, if a company decides to spend resources on developing a new product rather than improving an existing one, the opportunity cost is the potential profit it might have earned from enhancing the current product line. This concept extends beyond financial returns, covering factors like time, labor, and expertise, which are crucial for optimizing resource allocation.

Applications in Personal Decisions

On an individual level, opportunity cost plays a crucial role in various personal decisions. For example, choosing to spend money on a vacation means those funds cannot be invested or spent on other goods and services. Similarly, pursuing further education may involve the opportunity cost of lost income during that time period. More broadly, when individuals decide how to spend their time, such as choosing between leisure activities and part-time work, they are inherently considering the opportunity cost of their choices.

Examples in Business Context

Businesses frequently face scenarios where understanding opportunity cost can significantly impact their strategic decisions:

Investment Decisions: When a company decides to invest in one project over another, the foregone profits from the rejected project(s) become the opportunity cost. This requires evaluating potential returns and associated risks. For instance, a firm might choose to expand its manufacturing capacity instead of investing in new technology. The future benefits of the technological investment represent the opportunity cost of this decision.

Production Choices: Firms often need to decide which products to produce with their limited resources. The opportunity cost is the value of the products that are not produced. For example, if a factory allocates its resources to manufacture laptops instead of smartphones, the profits from unproduced smartphones constitute the opportunity cost.

The Role in Government Policy

Governments also must consider opportunity costs when allocating budgets across various sectors such as healthcare, education, and defense. A decision to allocate more funds to infrastructure might result in an opportunity cost of not enhancing healthcare services. In policy-making, understanding these trade-offs assists in crafting policies that balance societal needs with available resources.

Socio-Economic Implications

Opportunity cost doesn’t only affect direct economic decisions; it has broader implications on socio-economic planning. By recognizing opportunity costs, policymakers can prioritize sectors that promise the greatest aggregate benefit to society. For example, investing in education might lead to long-term economic growth, but the opportunity cost might be immediate infrastructure developments.

Limitations of Opportunity Cost

While opportunity cost is a valuable concept, it does have limitations due to subjective valuation and the challenge of measuring intangible and future benefits accurately. Estimations can be complex, leading to potential inaccuracies in decision-making frameworks. Moreover, opportunity costs are often only apparent with hindsight, complicating accurate predictions at the moment a decision is made.

Conclusion

Understanding opportunity cost is crucial for making rational and informed economic decisions. Whether it’s about personal budgeting or corporate investment, acknowledging what is sacrificed in favor of a chosen path enables better strategic planning. To further grasp opportunity cost concepts, explore more resources from trusted economic sites like Investopedia or The Economic Times.

By integrating opportunity cost analysis into decision-making processes, individuals and organizations can enhance their capacity to make choices that optimize their available resources and maximize potential benefits. Opportunity cost urges decision-makers to think critically about scarcity and prioritization, ultimately fostering a more efficient allocation of resources at every level, from personal finance to global economic policy.

To deepen your understanding of opportunity cost and its profound implications on decision-making, continuing education in economic theory and principles is valuable. Many universities and online platforms offer comprehensive courses on this subject, laying a solid groundwork for mastering economic strategy. By equipping themselves with this knowledge, individuals can navigate complex economic landscapes with greater confidence and insight, ensuring that their decisions align with long-term objectives.

Indeed, taking time to reflect on the less visible costs of our choices encourages a more nuanced perspective on economic decisions. This recognition goes beyond simple cost-benefit analyses, urging a broader view that considers not just immediate gains but also long-term impacts and opportunities missed. Through consistent practice and incorporation into strategic planning, the concept of opportunity cost can transform into an invaluable tool in both personal and professional arenas. It provokes deeper, more informed thinking, ultimately leading to outcomes that better serve the growth and sustainability aspirations of all economic participants.

- Written by: admin

- Category: Uncategorized

- Published: June 22, 2025

The Role of Productivity in Economic Growth

Productivity is a critical factor in understanding economic growth. The connection between productivity and economic growth is well-established within economic theory, as increased productivity is often synonymous with a more robust and resilient economy. In its simplest form, productivity measures how efficiently production inputs, such as labor and capital, are utilized to produce a given level of output. An exploration of this concept provides profound insights into how economies can grow and develop over time.

Understanding Productivity

Productivity can be defined as the ratio of output to input. It serves as an essential indicator of efficiency, reflecting how well resources are utilized within an economy. This metric is crucial for businesses, policymakers, and economists because it provides insight into the functioning and potential growth of an economy. When productivity increases, it often indicates that more goods and services are being produced from the same amount of resources, subsequently leading to economic growth.

Productivity is not just about producing more goods with the same resources; it is also about improving quality. When businesses become more productive, they can invest resources in enhancing the quality of their products and services. This dual focus on quantity and quality can drive consumer satisfaction and further fuel economic growth.

Why Productivity Matters for Economic Growth

Increases in productivity are crucial for sustaining long-term economic growth. Rising productivity allows economies to produce more goods and services without a proportional increase in the input of labor and capital. This results in several economic benefits:

Enhanced Living Standards: As productivity grows, so too do wages and the standard of living. Businesses can afford to pay more when they generate higher outputs with the same input costs. Increased wages result in higher consumer spending, contributing to further economic expansion.

Increased Competitiveness: Economies that demonstrate high productivity levels can more effectively compete in the global market. This competitive advantage can lead to a greater share of international markets and increased export revenues. By being able to produce at lower costs or higher qualities, businesses can expand their market reach and economic influence.

Innovation and Technological Advancements: High productivity often correlates with innovation. Businesses and economies that engage in research and development can improve their processes and technologies, thereby enhancing productivity further. The relationship between innovation and productivity is cyclical—innovation leads to productivity gains, which fund further research and development.

The Mechanisms of Productivity Growth

Several important mechanisms enhance productivity:

Technology and Innovation: Advances in technology, such as automation and digitalization, directly contribute to productivity gains by allowing for more efficient production processes. Companies that invest in cutting-edge technologies often find themselves at the forefront of their industries, benefiting from reduced costs and increased production speeds.

Human Capital Improvements: Education and training play crucial roles in increasing the skill levels of the workforce. A well-educated workforce is more capable of innovating and adapting to new technologies, improving the overall ability to contribute effectively to the production process. Investment in human capital is, therefore, a key component of national and business strategies for boosting productivity.

Efficient Resource Allocation: Proper allocation of resources ensures that capital, labor, and materials are used where they are most effective, minimizing waste and maximizing output. Economies that prioritize efficient resource use can achieve significant productivity improvements, contributing to sustainable growth.

Challenges and Considerations

While productivity growth is a fundamental component of economic development, it is not without its challenges. One significant issue is that technological advances can lead to disruptions in the labor market, necessitating policy interventions to address potential unemployment or underemployment. As automation and artificial intelligence replace certain jobs, economies must transition workers into new roles and industries.

Another challenge lies in the measurement of productivity, especially in service-oriented economies where outputs are not always tangible. Measuring productivity in sectors like healthcare, education, or creative industries can be complex, as quality improvements and consumer satisfaction must be considered alongside raw output figures.

Moreover, environmental sustainability poses a challenge. Increasing productivity must be balanced with ecological considerations to ensure long-term economic health without depleting natural resources. Policymakers must craft strategies that encourage green technologies and sustainable practices.

Conclusion

Understanding the importance of productivity in economic growth reveals that strategies to improve productivity are crucial for policymakers and businesses alike. Investing in technological innovation, education, and efficient resource management can potentiate a cycle of sustained economic prosperity. Strategies might include policies to support lifelong learning, incentives for research and development, and frameworks that encourage smart and sustainable resource use.

Therefore, productivity remains a pivotal focus for driving economic advancement and improving living standards worldwide. Addressing the challenges associated with productivity growth requires coordinated efforts across various sectors and disciplines, ensuring that economies can enjoy the benefits of higher productivity without the associated drawbacks. By doing so, nations can achieve robust economic growth that is inclusive, sustainable, and resilient in face of global challenges. For more insights on economic growth strategies, visit this resource.

- Written by: admin

- Category: Uncategorized

- Published: June 15, 2025

Understanding Trade Surplus and Trade Deficit

A country’s economic health is often gauged by its balance of trade, which measures the difference between the value of its exports and imports. Two critical concepts in this context are trade surplus and trade deficit.

What is a Trade Surplus?

A trade surplus occurs when the value of a country’s exports exceeds the value of its imports over a given period. This surplus indicates that the country is selling more goods and services to foreign countries than it is purchasing from them. A trade surplus can be seen as a sign of economic strength, as it suggests that the global demand for the country’s goods or services is strong.

Benefits of a Trade Surplus

By maintaining a trade surplus, a country might increase its foreign currency reserves, enhance the global competitiveness of its industries, and potentially strengthen its currency. Countries often aim for a trade surplus to encourage industrial growth and job creation.

Increase in Foreign Currency Reserves

One substantial advantage of having a trade surplus is the potential increase in foreign currency reserves. When a nation exports more than it imports, it typically receives foreign currencies in exchange for its goods and services. These currencies can then be used to stabilize the country’s own currency, manage inflation, and finance imports of essential goods that are not produced domestically. The accumulation of foreign reserves provides a financial cushion that can be advantageous in times of economic uncertainty.

Enhancement of Industry Competitiveness

Another significant benefit of a trade surplus is the enhanced competitiveness of national industries on the global stage. When a country’s products are in demand internationally, it often drives innovation and efficiency as businesses strive to maintain or increase market share. This push for better quality products or more efficient production processes can lead to a more robust national economy and greater industrial growth over time.

Potential Strengthening of Currency

A sustained trade surplus may lead to an appreciation of the national currency. As demand for the country’s exports increases, foreign buyers need the local currency to pay for these goods, thereby increasing its value. A stronger currency makes imports cheaper, benefiting consumers and businesses that rely on imported goods. However, it can also pose challenges for exporters, as their goods may become relatively more expensive for foreign buyers.

What is a Trade Deficit?

In contrast, a trade deficit happens when the value of a country’s imports exceeds the value of its exports. This means that the country is buying more from other countries than it is selling to them. While sometimes perceived negatively, a trade deficit can also suggest a robust consumer demand within a country.

Implications of a Trade Deficit

Trade deficits can have multiple implications. On the one hand, they may indicate a growing economy with strong consumer purchasing power. On the other hand, persistent trade deficits might signal competitive weaknesses and could lead to increased foreign debt if funded through borrowing.

Indicator of Strong Consumer Demand

One interpretation of a trade deficit is that it reflects buoyant consumer demand, as citizens or businesses buy more goods than the country produces. This dynamic can be beneficial, particularly in economies where domestic production is not sufficient to satisfy consumer demand. It suggests that the country’s residents have the financial means to purchase goods from abroad, supporting a high standard of living and diverse market offerings.

Potential Drawbacks of a Persistent Trade Deficit

Despite the potential positives, persistent trade deficits can signal underlying economic issues. Over time, relying heavily on imports can indicate that domestic industries are not competitive or innovative enough to meet market demands. This dependence on foreign goods and services might create vulnerabilities, especially if it leads to significant borrowing from other countries. The accrued debt can burden future generations, impacting socioeconomic planning and development efforts.

Trade Balance and Economic Policies

The balance of trade, whether a surplus or deficit, often influences a country’s economic policies. Policymakers may implement measures to adjust the balance, such as tariffs to protect domestic industries, or subsidies to boost exports. However, such measures can lead to international trade tensions.

Tariffs and Trade Protection

One method countries use to address trade imbalances is the application of tariffs on imported goods. Tariffs increase the cost of foreign products, making them less competitive compared to local production. This approach seeks to protect domestic industries from international competition, fostering growth and job creation within the country’s borders.

Subsidies and Export Promotion

Another strategy involves subsidies aimed at promoting exports. By offering financial advantages to key industries, governments strive to make their domestic goods and services more appealing in international markets. Increased exports can help narrow a trade deficit or contribute to expanding a trade surplus by enhancing the competitive edge of national enterprises.

Impacts on International Trade Relations

While such policies can adjust trade balances, they may also generate friction between countries. Tariffs, for instance, can lead to retaliatory measures, sparking trade disputes. Similarly, subsidies might be perceived as unfair competition, leading to grievances in international forums. These complexities underscore the delicate nature of trade negotiations and the importance of cooperation in achieving mutually beneficial outcomes.

Conclusion

Both trade surpluses and trade deficits have distinct impacts on a nation’s economy. While a surplus can signify strong international demand, a deficit may reflect dynamic domestic consumption. Understanding these concepts helps in analyzing a country’s economic strategy and its implications for global trade dynamics. In essence, a nuanced view of trade balances can provide deeper insights into the economic landscape, enabling policymakers and businesses to make informed decisions in an interconnected world. Such insight is crucial in crafting strategies that safeguard national interests while fostering international collaboration and stability.

- Written by: admin

- Category: Uncategorized

- Published: June 8, 2025

Introduction to Exchange Rates

Exchange rates serve as a pivotal element in the realm of economics and finance, influencing how currencies are exchanged on the global stage. At their core, exchange rates dictate the value of one currency in terms of another, playing an integral role in international trade, investment, and travel. A comprehensive understanding of exchange rates necessitates an exploration of the reasons behind their fluctuations and their broader impact on global economies.

What Influences Exchange Rates?

The dynamics of exchange rates are multifaceted and are swayed by various economic indicators and external factors. Among the most significant influences are interest rates, inflation, and a country’s economic stability.

Interest rates are crucial as they directly affect how attractive a currency is to investors. Countries boasting higher interest rates tend to draw increased foreign capital, as investors seek better returns on their investments, leading to an appreciation of that country’s currency. Conversely, nations with lower interest rates may see their currency value decline as investors look elsewhere for better returns.

Inflation also plays a critical role. When a country experiences high inflation, its currency typically depreciates because inflation diminishes purchasing power. People and businesses would need more of that currency to buy the same goods and services, causing the currency to lose value on the international stage.

Economic Stability and Confidence

Economic stability and investor confidence are significant factors in determining the valuation of a country’s currency. A nation enjoying political stability and robust economic performance is likely to inspire confidence among investors, potentially leading to currency strength. On the other hand, political turmoil or economic challenges can deter investment, causing a currency to weaken. Thus, confidence and perception can materially affect currency value beyond mere statistical measurements.

Supply and Demand Dynamics

The law of supply and demand is a fundamental principle when it comes to foreign exchange markets. The value of a currency is largely dictated by its demand relative to its supply. An increase in demand for a particular currency, driven by factors such as attractive interest rates or a booming export sector, often results in an appreciation of that currency.

Role of Central Banks

Central banks wield considerable influence over exchange rates using monetary policy and direct interventions in foreign exchange markets. They may opt to buy or sell their own currency to achieve desired economic objectives, such as controlling inflation or boosting exports. Such interventions can have immediate effects and are often part of broader policy strategies aimed at maintaining or adjusting economic equilibrium.

The Impact of Speculation

The foreign exchange market is highly susceptible to speculation, where traders and investors act based on their expectations of future currency movements. This speculative activity can introduce considerable volatility into the market as participants react to anticipated economic changes, such as shifts in monetary policy.

Long-term Valuation

While speculation can drive short-term fluctuations, long-term currency valuation relies more heavily on fundamental economic factors. GDP growth, productivity improvements, and the balance of trade are key indicators that analysts consider when evaluating a currency’s longer-term prospects. Over time, these stable indicators tend to provide a more reliable foundation for assessing currency strength.

Effects on International Trade

Exchange rates significantly influence international trade dynamics. A strong national currency can render a country’s exports more expensive for foreign buyers, potentially leading to a trade deficit as exports dwindle. Conversely, a weaker currency can render exports cheaper and imports more costly, potentially fostering a trade surplus. Consequently, nations must carefully manage their exchange rates to maintain favorable trade conditions.

Impact on Consumers and Businesses

The ripples of exchange rate fluctuations extend to consumers and businesses engaged in international commerce. For consumers, exchange rates directly impact the cost of imported goods and travel expenses. A stronger domestic currency generally means cheaper overseas travel and imported products.

Businesses, particularly those trading internationally, face the challenge of managing exchange rate risk, which refers to the potential for financial loss due to unfavorable currency movements. To mitigate this risk, companies often employ hedging strategies, such as using financial contracts to lock in exchange rates, safeguarding against unexpected shifts.

Tools for Understanding Exchange Rates

For those interested in understanding exchange rates more deeply, an array of online resources and analytical tools are available. Financial websites provide users access to real-time exchange rate data, allowing them to monitor changes as they happen. Furthermore, these platforms often offer economic analyses and forecasts, providing insight into potential future movements.

To gain more thorough expertise, individuals may explore publications from renowned financial institutions and international economic organizations. These resources delve into the intricacies of currency valuation and foreign exchange markets with significant depth.

Conclusion

A solid grasp of exchange rates and currency valuation is indispensable for anyone participating in global markets—be they a consumer, investor, or business owner. This complex subject encompasses a variety of factors, ranging from macroeconomic indicators to market psychology and government interventions. By understanding these dynamics, individuals and businesses can better navigate the complexities of the international financial landscape, making more informed decisions and adapting to an ever-changing economic environment.

- Written by: admin

- Category: Uncategorized

- Published: June 1, 2025

Understanding Hyperinflation

Hyperinflation represents an extreme and often alarming phase of inflation characterized by an unusually rapid escalation of prices in an economy over a brief period. When such an inflationary surge occurs, the inflation rate exponentially surpasses typical levels, escalating beyond 50% per month or reaching over 1,000% annually. This swift and rampant inflation severely erodes the purchasing power of the currency, leading to widespread economic implications.

Causes of Hyperinflation

Hyperinflation is generally triggered by a variety of interrelated factors, predominantly involving the excessive expansion of the money supply without underlying economic growth. When a government opts to print more currency to bridge its fiscal deficits or fund expenditures without a proportionate rise in goods and services, the currency’s value diminishes. Here, we delve deeper into the principal causes:

Loss of Confidence in the Currency: One of the critical precursors to hyperinflation is the erosion of trust among the populace in the stability and value of their currency. When faith in the currency wanes, individuals and businesses become less inclined to retain it, instead seeking to convert their holdings into more stable assets or foreign currencies. This rush to ‘dump’ the currency further accelerates its devaluation.

Political Instability: Hyperinflation often coincides with periods of political turbulence. In such scenarios, governments might resort to excessive money printing as a quick fix to address immediate financial obligations or to fund populist measures aimed at quelling dissent. Unfortunately, while this might provide short-term relief, it typically exacerbates the inflationary situation, fuelling further currency depreciation.

Economic Shocks: Significant and sudden economic shocks, such as wars, revolutions, or natural disasters, can drastically curb an economy’s capacity to produce and supply goods. These disruptions lead to shortages that, when combined with an inflated money supply, can spiral into hyperinflation. The diminished production capacity means fewer goods chasing more money, inevitably inflating prices.

Historical Examples

Although hyperinflation is relatively rare, history offers poignant lessons through several striking examples that underscore the destructive power of unrestrained price surges:

Germany in the 1920s: The post-World War I era was a tumultuous time for Germany, grappling with the economic aftermath of the Treaty of Versailles. The onerous reparations payments, compounded by a need to stimulate growth within a battered economy, led the Weimar government to print more money. This decision inadvertently triggered hyperinflation, reaching dramatic levels where prices doubled almost daily at its height, causing immense social and economic challenges.

Zimbabwe in the Late 2000s: Zimbabwe’s hyperinflationary crisis became a textbook example of economic collapse. The catalyst was a series of contentious land reforms coupled with a significant decline in agricultural production. In a desperate attempt to sustain the economy, the government printed money recklessly, culminating in an astronomical inflation rate that reportedly peaked at 89.7 sextillion percent per month. The consequences were catastrophic, leading to severe poverty and the collapse of the country’s financial system.

Venezuela in the 2010s: The hyperinflation experienced by Venezuela in recent years stemmed largely from weak economic policies and a drastic drop in global oil prices, heavily affecting the country’s oil-dependent economy. Government mismanagement paired with persistent monetary expansion led to hyperinflation, drastically reducing purchasing power and causing widespread socioeconomic disruption. The decline in basic living standards was compounded by shortages of essential goods and services.

Consequences of Hyperinflation

The onset of hyperinflation signals profound disruption within an economy, with pervasive and multifaceted consequences. Its impacts are wide-ranging and typically involve:

Erosion of Savings: Hyperinflation rapidly dilutes the value of accumulated savings. Both individual savers and financial institutions find their reserves diminishing in real terms, eroding wealth and destabilizing banking systems.

Reduction in Purchasing Power: Hyperinflation creates a scenario whereby wages and salaries fail to keep pace with soaring prices. Consequently, people find their standard of living drastically reduced as basic goods and services become unaffordable, accentuating economic inequality and societal distress.

Market Instability: With prices changing rapidly and unpredictably, market conditions become volatile. Businesses struggle to plan and operate effectively, often leading to supply chain disruptions and shortages. This instability not only constrains economic growth but also breeds an environment where speculative behaviors can thrive.

Barter Economies: As hyperinflation devalues the local currency, trust and utility in money as a medium of exchange decline. People revert to bartering—trading goods and services directly—as a more reliable means of transaction. While barter might offer a temporary solution for some, it leads to inefficiencies and highlights the breakdown of the formal monetary system.

For those interested in exploring the intricate dynamics of hyperinflation and its broader implications on global economies, extensive resources and scholarly investigations are accessible. Academic publications and research institutions frequently offer comprehensive analyses and elucidations of historical instances of hyperinflation, providing deeper insights into its systemic repercussions and preventive strategies.

Conclusion

Hyperinflation, though not frequently encountered, remains a perilous economic phenomenon due to its potential to wreak havoc on economies and societies. Comprehending its underpinning causes and far-reaching consequences is crucial for economists, policymakers, and the public alike. By identifying emerging signs of monetary instability and implementing sound economic policies, it is possible to forestall hyperinflationary cycles and mitigate their impact, safeguarding regional and global economic stability.